Carbon neutrality/climate change action

Basic approach

Idemitsu Kosan aims to fulfill its "responsibility to support people's lives" and "Responsibility to protect the global environment now and in the future" by leveraging its group's strength of "provide for society capabilities" to realize a carbon-neutral (CN) and recycling-oriented society. With regard to its efforts to address climate change, while continuing to disclose information in accordance with the TCFD recommendations, which it signed in 2020, it will also expand disclosure with an eye toward disclosure within the IFRS S2/SSBJ framework, and will accelerate its efforts with the understanding and cooperation of all stakeholders.

Signing of support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)

On February 14, 2020, we endorsed and signed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Climate change-related disclosures on this website

The pages on which each item of the TCFD framework is posted on this website are listed in the table below.

| Region | TCFD recommendations | Our disclosure |

|---|---|---|

| Governance | 1. Explain Board of Directors 's oversight of climate-related risks and opportunities. | Governance |

| ② Explain the role of management in assessing and managing climate-related risks and opportunities. | ||

| Strategy | ① Describe the short-, medium-, and long-term climate-related risks and opportunities that the organization has identified. |

Message from the Executive Officer Strategy |

| ② Explain the impact of climate-related risks and opportunities on the organization's business strategy and financial planning. | ||

| ③ Explain the resilience of the organization's strategy based on considerations based on various climate-related scenarios, including the 2°C or lower scenario. | ||

| Risk management | ① Describe the process by which the organization identifies and assesses climate-related risks. | Risk management |

| ② Explain the process by which the organization manages climate-related risks. | ||

| ③ Describe how the organization's processes for identifying, assessing, and managing climate-related risks are integrated into the organization's overall risk management. | ||

| Metrics and targets | ① The organization discloses the metrics it uses to assess climate-related risks and opportunities in line with its own strategy and risk management processes. | Metrics and targets |

| ② Explain Scope 1, Scope 2, and if applicable to the organization, Scope 3 GHG emissions and related risks. | CO₂ emissions (Scope 1, 2, 3) actual trends | |

| ③ Disclose the goals the organization uses to manage climate-related risks and opportunities, and its performance against those goals. | Metrics and targets |

(Supplementary item)

| Region | TCFD recommendations | Our disclosure |

|---|---|---|

| Greenhouse gas emissions | Absolute emissions and emissions intensity for Scope 1, 2, and 3 | CO₂ emissions (Scope 1, 2, 3) actual trends |

| Transition | The amount and scope of assets or business activities vulnerable to transition risks; | Risks and opportunities |

| Physical risk | The amount and extent of assets or business activities vulnerable to physical risks; | Risks and opportunities |

| Climate-related opportunities | Proportion of revenue, assets and business activities linked to climate-related opportunities | Risks and opportunities |

| Capital deployment | Capital expenditures, financing and total amounts deployed towards climate-related risks and opportunities | Investment decision-making system |

| ICP | Price per ton of CO₂ emissions used within the organization (internal carbon price) | Strategy |

| Reward | Proportion of executive compensation linked to climate considerations | Executive compensation |

Governance

An overview of our corporate governance system is provided in the link below, and supplementary information regarding our response to climate change is provided below.

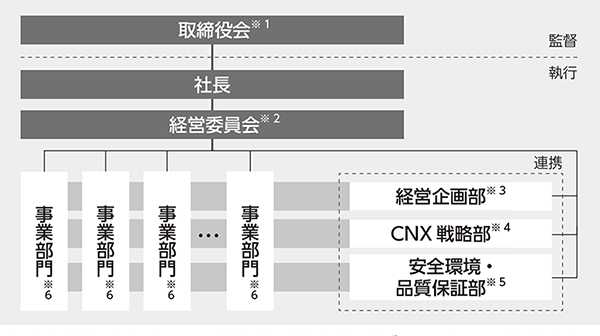

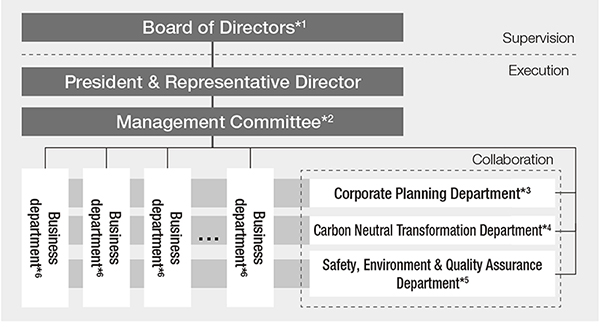

Climate-related governance structure

In order to address climate change, one of our most important management issues, Board of Directors of Directors is tasked with determining management policies that consider this issue from multiple angles and perspectives, and overseeing the prompt and steady implementation of actions based on those policies. Major climate change-related agenda items are submitted to Management Committee, and particularly important agenda items are reported to Board of Directors. This allows Board of Directors to oversee whether company-wide policies are being steadily implemented.

The 10 members of Board of Directors have experience, achievements, and knowledge in a wide range of fields, including the environment, Resources circulation, domestic and international energy transition trends, related advanced technologies, and sustainability.

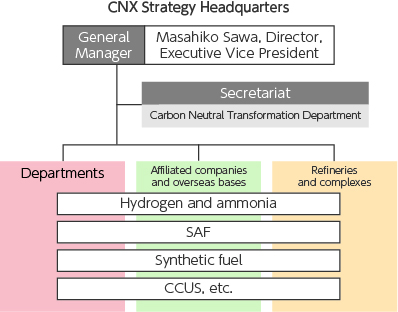

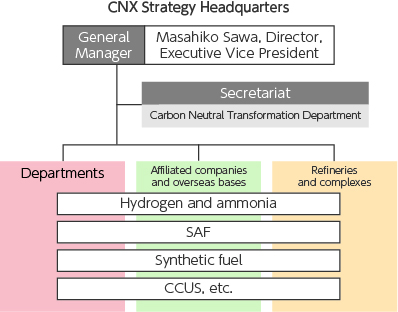

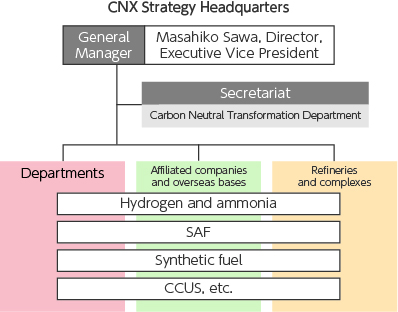

Furthermore, the planning and implementation of company-wide strategies to realize carbon neutrality society is being driven primarily by a specialized department (CNX* Strategy Department), which leads the formulation of company-wide CN strategies, setting GHG reduction targets, and CNX human resource development in cooperation with related internal departments.

-

CNX: Carbon Neutral Transformation

*1 Establishment of management policies based on climate change issues Supervising the implementation of actions based on policies

*2 Deliberation of major climate-related topics

*3 Scenario analysis, company-wide investment and loan policy formulation and management

*4 Company-wide CN strategy planning, GHG reduction target setting, progress monitoring of each department strategy

*5 GHG emissions capture and monitoring

*6 CN strategy planning and execution by business division

Linking climate change responses to executive compensation

The remuneration system for our directors (excluding part-time directors and outside directors) and senior executive officers and above consists of ① fixed compensation, ② performance-linked bonuses, ③ performance-linked stock compensation, and ③ performance-linked stock compensation. It also includes CO₂ reduction indicators that are essential for realizing a carbon-neutral, recycling-oriented society.

Strategy

Scenario analysis

Long-term energy business environment scenario towards 2050

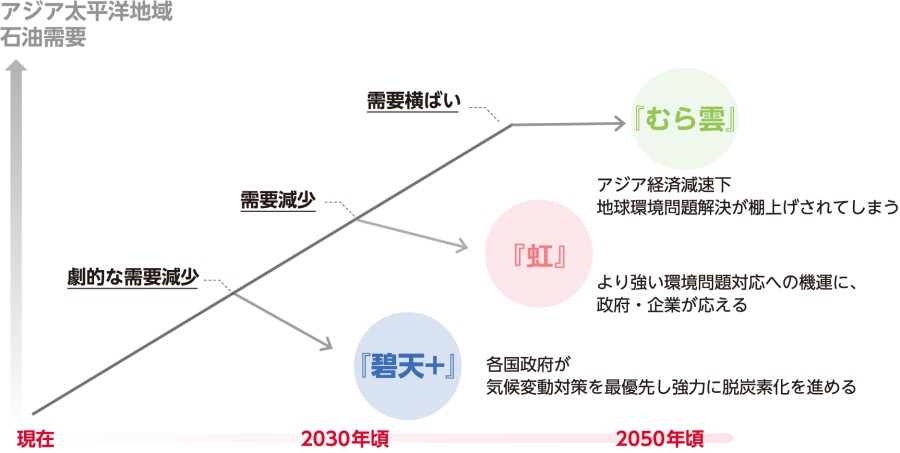

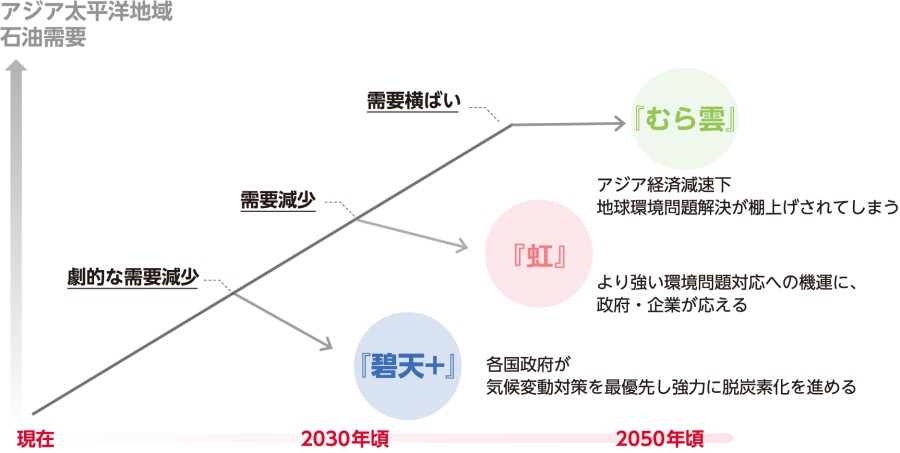

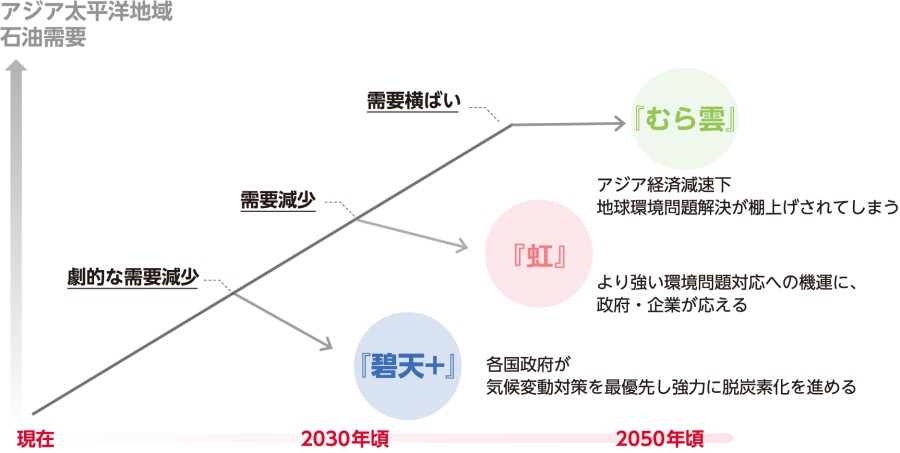

In examining specific responses to climate change, we are formulating long-term business environment scenarios covering the period up to 2050, identifying risks and opportunities based on the output of those scenarios, and proceeding with formulating specific strategies.

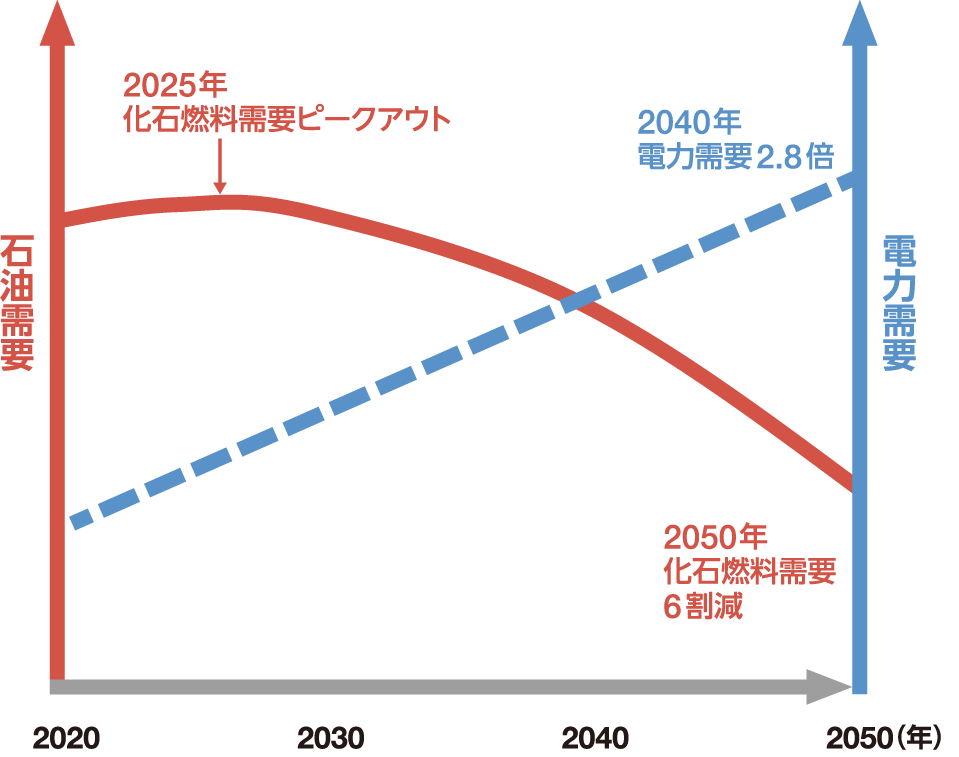

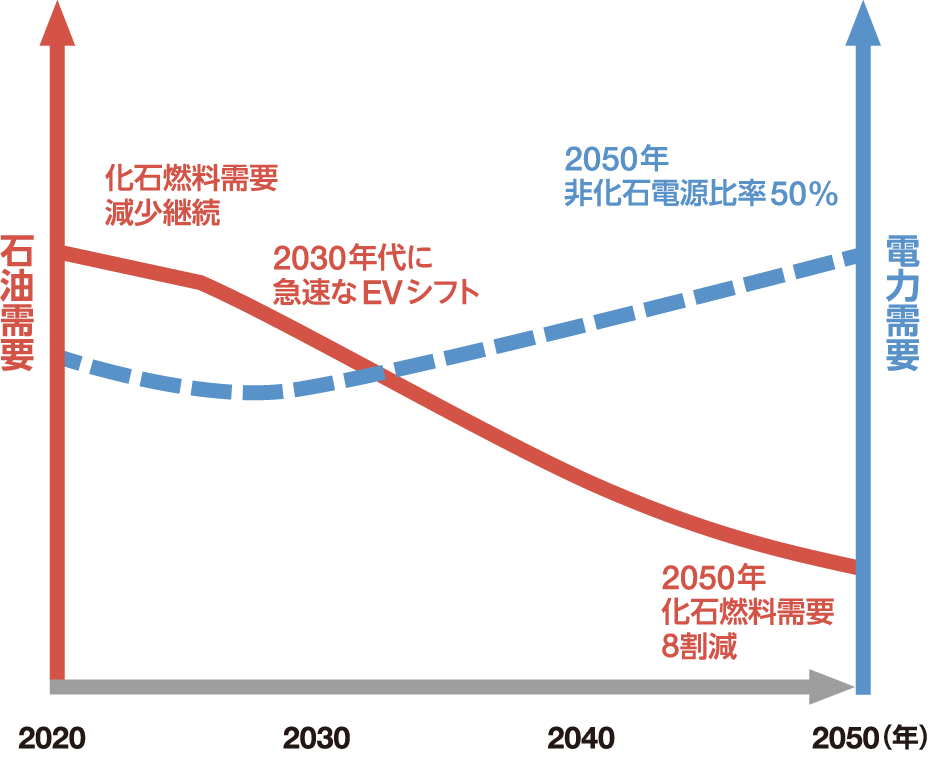

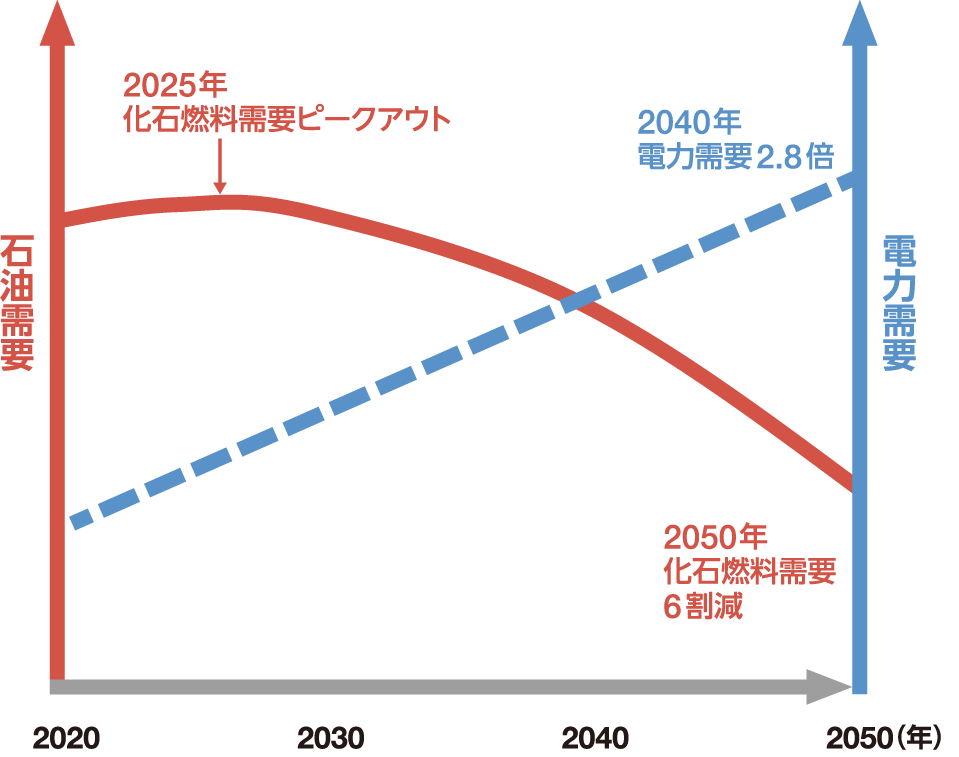

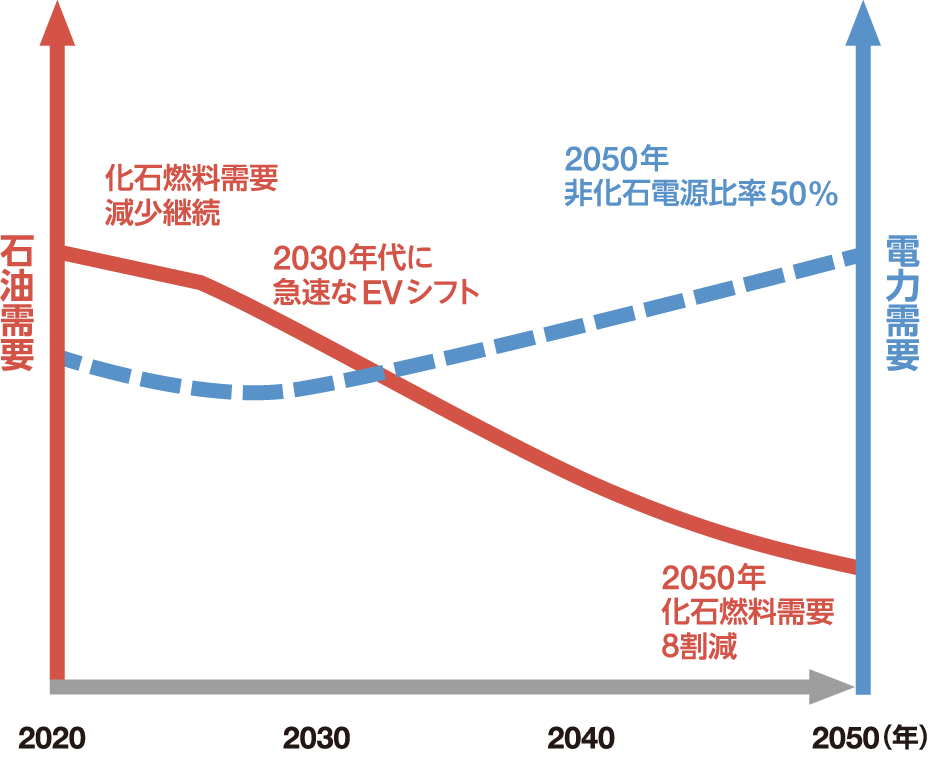

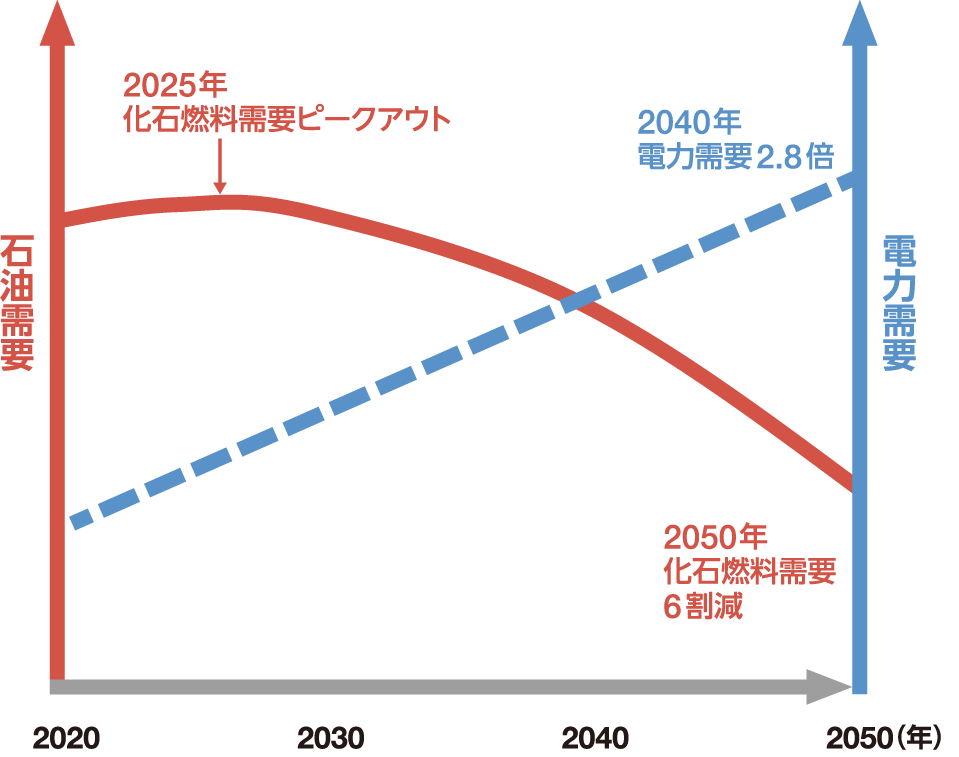

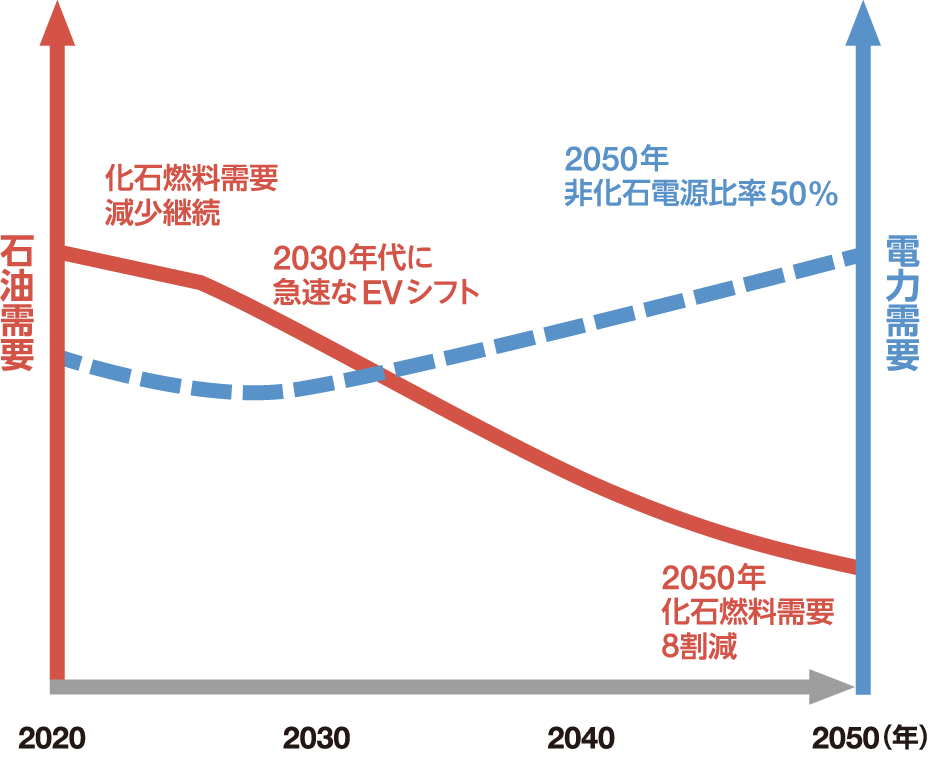

Since publicly announcing our first business environment scenario in 2019, we have reviewed the scenarios as necessary in response to changes in the social environment. In considering Medium-term Management Plan (FY2023-FY2025), we have envisioned three scenarios, and of these, we have formulated our plan with a strong focus on the "Hekisentei +" scenario, which is similar to the IEA's net zero scenario in which decarbonization will progress the most.

The Hekiten+ scenario assumes a world in which governments will rapidly implement measures to achieve the 1.5°C target, and various decarbonization technologies will be provide for society at a very fast pace, achieving the 2050 CN. In this scenario, in addition to renewable energy, various decarbonization technologies will be introduced, such as nuclear power generation, hydrogen and ammonia combustion power generation, thermal power generation with CCS (Carbon Capture and Storage), synthetic fuel, and negative emissions, and the goals of the Paris Agreement will be achieved through an all-out war. In addition, oil demand in the Asia-Pacific region is expected to peak in 2025, and domestic oil demand is expected to decrease by 30% in 2030, 60% in 2040, and 80% in 2050 compared to 2019.

*The three business environment scenarios are unique to our company, but the following are scenarios from other organizations that are similar to each scenario.

Cloud: IEA Stated Policies Scenario

Rainbow: Between the IEA Stated Policies Scenario and the Sustainable Development Scenario

Hekiten+: IEA Net Zero Emissions by 2050 Scenario

●Long-term energy demand outlook

Asia Pacific

Japan

Asia Pacific

Japan

Asia Pacific

Japan

Risks and opportunities

We are identifying risks and opportunities related to climate change based on long-term business environment scenarios leading up to 2050. For each area, we have compiled the expected timeframe, level of financial impact, and our response, and are proceeding with specific initiatives in accordance with the details in the table below.

In response to risks and opportunities, we will work to strengthen profitability and capital efficiency in existing businesses, create new businesses through investments in business structure reforms, and transform our business portfolio, etc. Through these efforts, we aim to achieve an operating profit + equity in earnings of 270 billion yen by 2030.

| Classification | Content | Time axis | Financial impact *1 | Our response | ||||

|---|---|---|---|---|---|---|---|---|

| ~2025 | ~2030 | ~2050 | level 1 |

level 2 |

level 3 |

|||

|

Move line Li vinegar nine Transition risks |

Decrease in domestic fossil fuel demand | ● | ● | ● | ✓ |

|

||

| Decreasing energy and Resources prices due to technological innovation | ● | ● | ✓ |

|

||||

| Full-scale introduction of carbon pricing by the government | ● | ● |

|

|||||

| Restrictions on fossil Resources mining businesses and cautious investment and lending stance of financial institutions | ● | ● | ✓ |

|

||||

| Declining brand image for companies with high carbon emissions | ● | ● |

|

|||||

|

thing Reason Li vinegar nine Physical risks |

Damage to coastal bases and impact on operations due to natural disasters and sea level rise | ● | ● | ✓ |

|

|||

| Impact on land and sea transportation due to abnormal precipitation and frequent typhoons, etc. | ● | ● |

|

|||||

|

machine Association Opportunities |

Increasing demand for fossil alternative fuels (solid fuels) | ● | ● | ✓ |

|

|||

| Increasing demand for fossil fuels (gaseous fuels) | ● |

|

||||||

| Increasing demand for fossil alternative fuels (liquid fuels) | ● | ● |

|

|||||

| Increasing importance of low-carbon fuel/raw material supply bases | ● | ● |

|

|||||

| carbon neutrality society | ● | ● | ✓ |

|

||||

| Growing demand for next-generation storage batteries | ● | ● |

|

|||||

| Full-scale expansion of recycling to realize a recycling-oriented society | ● | ● |

|

|||||

| Stable supply of energy to local communities | ● | ● | ● | ✓ |

|

|||

| Expansion of electric vehicles | ● | ● | ● |

|

||||

| Growing demand for renewable energy | ● | ● | ● |

|

||||

| Evolution of distributed energy systems and growing demand | ● | ● | ● |

|

||||

*1 Financial impact over a long-term timeline Level 1: ~5 billion yen, Level 2: 5 billion yen ~ 50 billion yen, Level 3: ~50 billion yen

*2 Super engineering plastics, oxide semiconductors, high-performance asphalt, environmentally friendly agricultural and livestock materials, etc.

Transition strategy

The "Our Responses" for the above risks and opportunities include potential provide for society themes up to 2030. We are working on these as part of our transition strategy towards 2050.

Investment decision-making system

We plan to invest a cumulative total of 800 billion yen by 2030 in new business expansion that will benefit CN.

Recognizing the need to accelerate the formulation and execution of company-wide issues to realize carbon neutrality society, we established the CNX Strategy Office (currently the CNX Strategy Department) in July 2021, and further established the CNX Strategy Headquarters in December 2023 to share information within the group and make rapid decisions. Under the structure shown in the diagram below, we have allocated personnel to each business division at a level of 250 people, and for each project that contributes to CN, we screened 16 projects set as new business themes from the perspective of market feasibility, the degree of utilization of existing assets, the presence or absence of major business partners and our own technological advantages, etc. As a result, we selected four businesses - blue ammonia, e-methanol, SAF, and lithium solid electrolytes as investments to be made toward CN in 2050 (CN investments) and have already begun concrete efforts.

For investments in new projects, we check changes in Scope 1, 2, and 3 emissions as well as changes in avoided emissions by others before and after the project, and then conduct a sensitivity analysis using an internal carbon price (100$/t-CO2). We use this information as a reference when evaluating investment projects.

-

CNX: Carbon Neutral Transformation

External evaluation of our transition strategy

Our transition strategy has been adopted as a model case for climate transition finance led by the Ministry of Economy, Trade and Industry.

Risk management

Metrics and targets

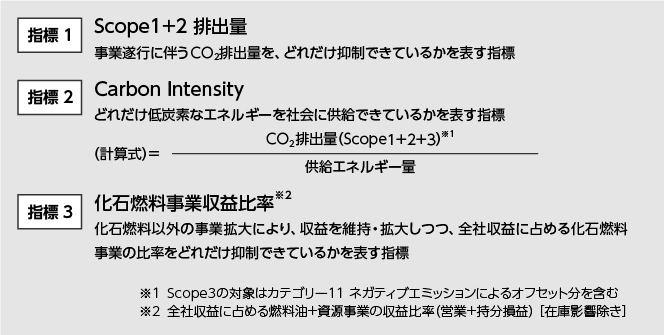

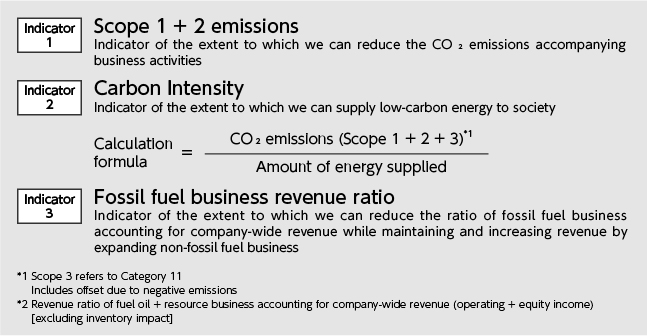

Concept of setting indicators

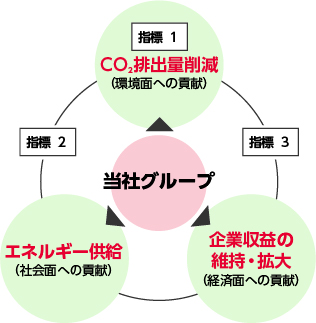

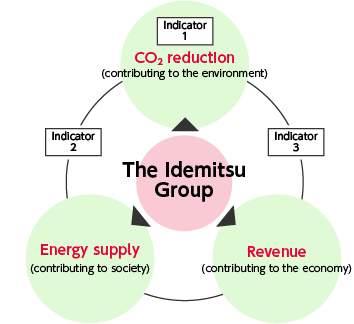

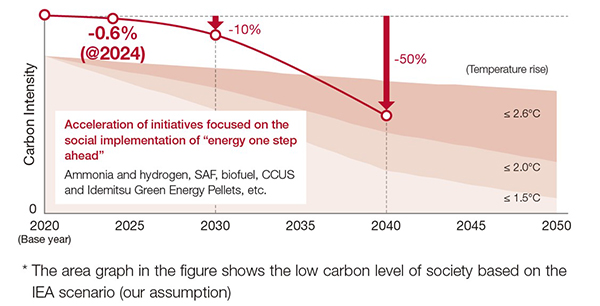

To realize carbon neutrality society, we believe it is necessary to address both the reduction of our own direct and indirect emissions associated with business operations (Scope 1 and 2) and the contribution to reducing emissions of others through the provision of new products and services (Scope 3 reductions, creating contributions to avoided emissions).

In proceeding with this initiative, we recognize that it is important to simultaneously contribute to the environment by reducing emissions, contribute to society by supplying energy, and contribute to the economy by maintaining and expanding corporate profits. Based on this recognition, we have set the following three indicators to monitor the progress of related activities.

-

Indicators 2 and 3 have been revised, taking into account the trends in international discussions on avoided emissions.

Indicator targets and progress

The target values (target levels) and actual results for fiscal 2024 for each indicator are as follows:

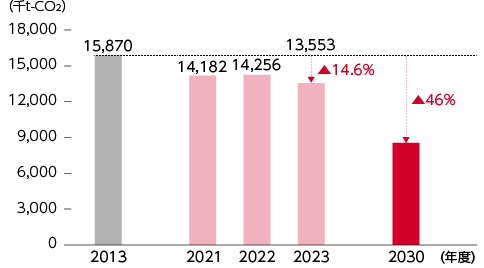

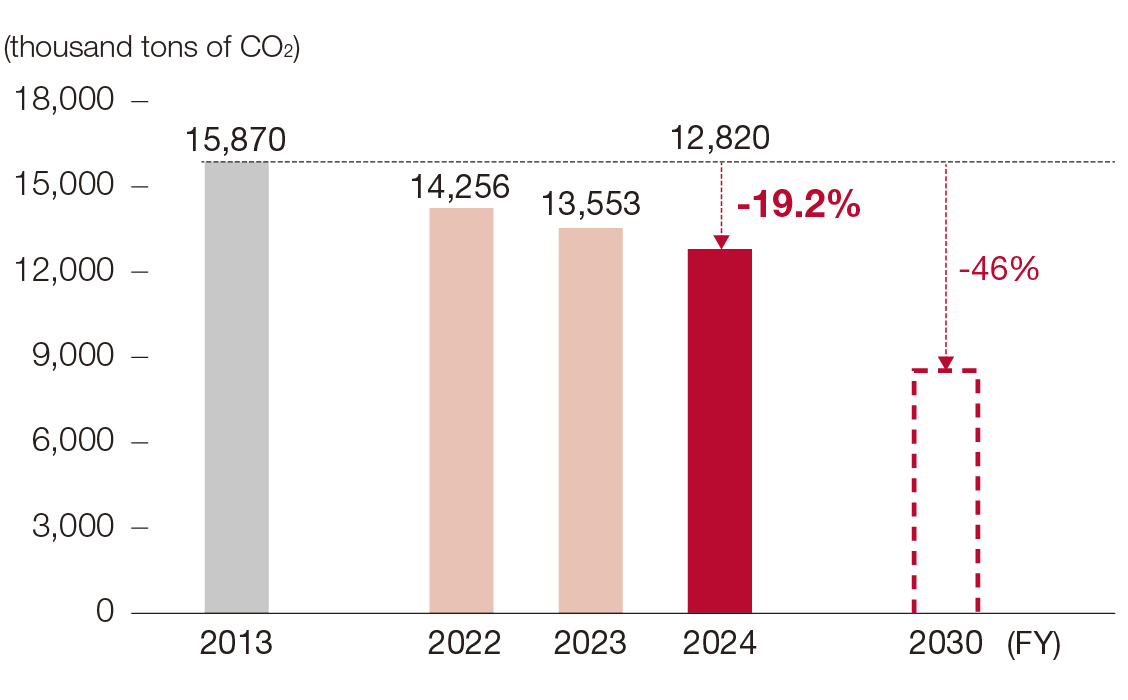

Indicator 1

(Scope1+2 emissions)2030: ▲46% (compared to 2013)

2050: Carbon neutral (CN)

2024 result: -19.2%

●Progress of this indicator

Indicator 2

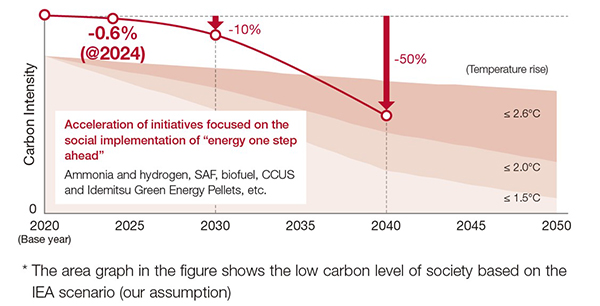

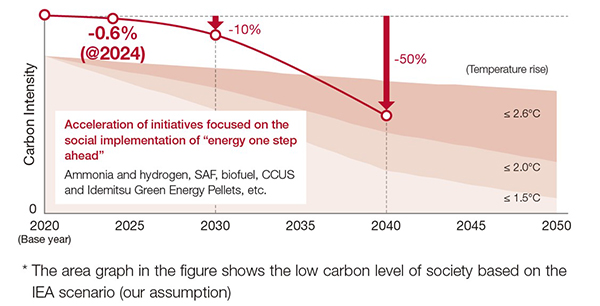

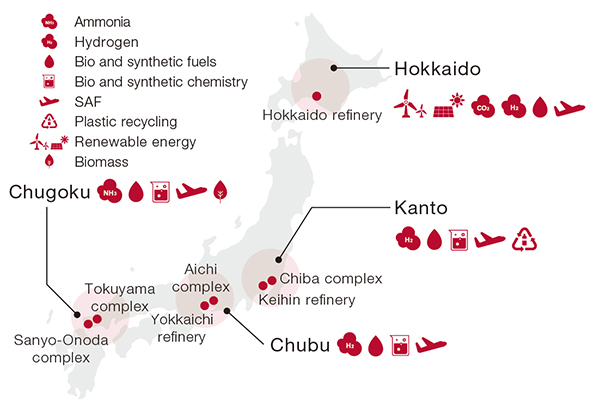

(Carbon Intensity)2030: ▲10% (compared to 2020)

2040: ▲50% (compared to 2020)

2024 result: -0.6%

Toward the realization of carbon neutrality society, we are working to reduce emissions throughout the supply chain, setting targets using an index called "Carbon Intensity" from the perspective of simultaneously contributing to the environment (reducing CO₂ emissions) and society (supplying the low-carbon energy that society needs).

Carbon Intensity (CI value) is an indicator that can be significantly reduced by provide for society" Energy one step ahead" in society, an initiative that we have set as a future business field and which will greatly contribute to Scope 3 reductions. We hope to contribute to the realization of carbon neutrality society through provide for society of "Energy one step ahead" in society.

| Provide for society theme | Estimated business scale | ||

|---|---|---|---|

| Unit | 2030 | 2040 | |

| Hydrogen/ammonia | Million tons | 100 | 400 |

| SAF, Biofuels, synthetic fuel | Million kL | 50 | 250 |

| Blending non-fossil fuels into gasoline * | % | 10 | 20 |

| Idemitsu Green Energy Pellets | Million tons | 300 | 300~ |

| Afforestation, CCS, etc. | Million tons | 100 | 700 |

* Target in 2030 assumes high-octane gasoline

●Progress of this indicator

This indicator can also be reduced by reducing the proportion of fossil fuels with high CI values and increasing the proportion of those with low CI values. The effect of these efforts has been a decline in the figure so far, with the reduction rate for fiscal 2024 being -0.6% compared to the base year.

-

The graph in the figure shows the low-carbon level of society (as assumed by our company) based on the IEA scenario.

Indicator 3

(Fossil fuel business revenue ratio)2030: 50% or less

2024 performance: 106.8%

●Image of reducing Scope 1, 2, and 3 emissions through business portfolio transformation

Initiatives

Reducing CO₂ emissions throughout the value chain

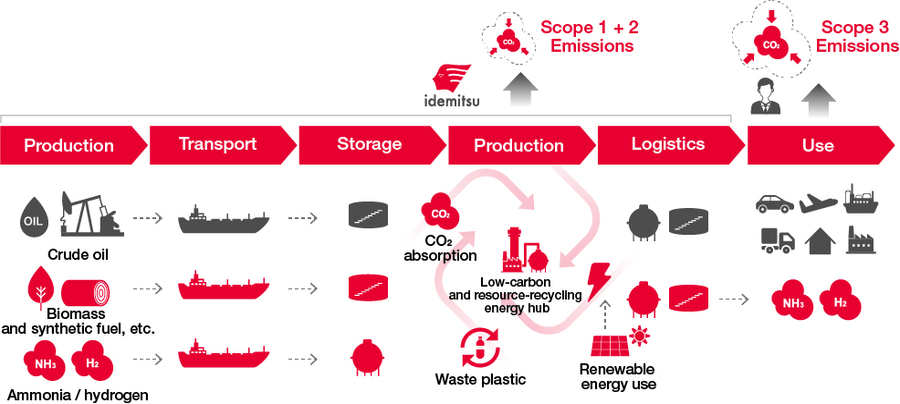

Establishment of CNXcenter concept

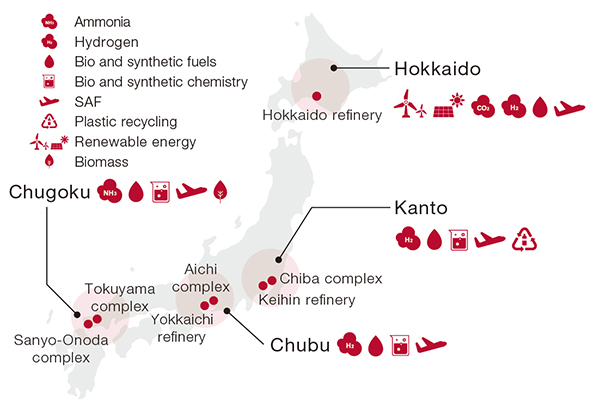

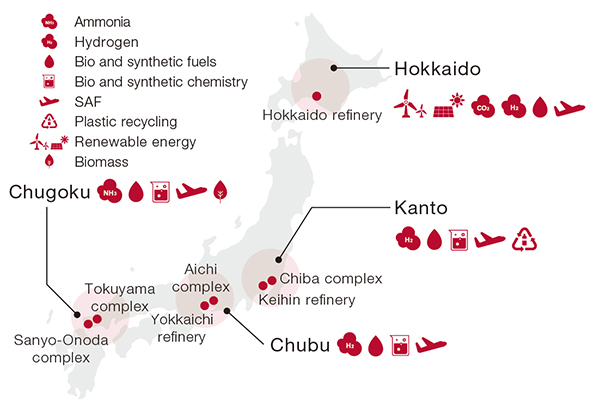

Our establishment of CNXcenter concept is to transform Refineries/Complexes have been operating for many years as fossil-derived energy production bases, into new supply bases for CN fuels and products, while taking advantage of their characteristics and strengths. In doing so, we will build a new supply chain that suits the characteristics and demand of the industrial complex where each base is located, and contribute to the CN conversion of the entire industrial complex.

●Conceptual image establishment of CNXcenter

Establishment of an ammonia supply chain in Tokuyama Complex and Shunan area

Together with Tosoh Co., Ltd., Tokuyama Co., Ltd., and Japan Zeon Co., Ltd., we have started a joint study with the aim of establishing a supply system for more than 1 million tons of carbon-free fuel ammonia per year at the Shunan Complex by 2030.

In addition, in February 2024, with the cooperation of IHI Corporation and IHI Plant Co., Ltd., we installed ammonia combustion equipment at the ethylene naphtha cracking furnace in Tokuyama Complex and conducted the first ammonia co-firing demonstration in Japan, confirming sufficient flammability and operational stability.

Going forward, we will continue to utilize this facility to accumulate data and know-how for the practical application of ammonia fuel, and to build a supply chain from the production and procurement of clean ammonia to the supply, and to conduct studies in cooperation with various stakeholders.

SAF manufacturing using ATJ process technology at Chiba Complex

We will work on developing the world's first 100,000 kL-class ATJ demonstration facility, construct an SAF production device using ATJ technology at Chiba Complex in fiscal year 2025, and start supplying it from fiscal year 2026. We will diversify our procurement of bioethanol, the raw material, from both domestic and overseas sources to build Japan's first large-scale supply chain and aim for the early provide for society of SAF. We will establish a production system for 500,000 kL per year by 2030.

Promoting energy conservation and zero emissions of power consumption

Implementation of efficiency improvement work on heavy oil direct desulfurization equipment

In May 2020, we carried out a modification work to improve the efficiency of the heavy oil direct desulfurization unit (RH unit) at Chiba Complex. This work is aimed at complying with the low sulfur content regulations for marine fuel set by the IMO (International Maritime Organization).

Replacing an old naphtha cracking furnace with a high-efficiency naphtha cracking furnace (Tokuyama Complex)

Tokuyama Complex established a new high-efficiency naphtha cracking furnace in 2021. This cracking furnace increases the yield of ethylene by pyrolyzing the raw material naphtha in a short time, thereby improving thermal efficiency.

It achieves energy savings of approximately 30% compared to conventional cracking reactors, contributing to a CO₂ reduction of approximately 16,000 tons per year.

Naphtha is one of the petroleum products, also known as crude gasoline, which is pyrolyzed in cracking furnaces to become the basic raw material for petrochemicals such as ethylene and propylene.

The ethylene and propylene produced are mainly supplied to Shunan Complex (Shunan City, Yamaguchi Prefecture).

With the introduction of this cracking furnace, we are working to reduce the environmental impact by stopping two old naphtha cracking reactors and replacing them with one high-efficiency cracking furnace.

Expanding the use of electricity derived from renewable energy

Since fiscal 2020, our CO₂-free electricity (contracted power: 3,732 kW) has been used at 17 oil terminal and other locations in Japan.

Supplying renewable energy to offshore oil fields

INPEX CORPORATION, an equity method affiliate of INPEX, has submitted a development plan for the introduction of floating offshore wind power generation to the Norwegian government through its local subsidiary INPEX Idemitsu Norge in the Snorre oil field, in which INPEX holds an interest, and has received approval from the government. In May 2023, INPEX began transmitting electricity from floating offshore wind power generation to the Snorre oil field. The development plan involves constructing an offshore wind farm (named Hywind Tampen floating wind farm) consisting of 11 floating offshore wind power generation facilities with a rated capacity of 8,000 kW (total of 88,000 kW) approximately 200 km off the coast of Bergen in western Norway, and directly connecting it to oil and gas production facilities, which is a world first. INPEX will continue to actively adopt advanced technologies and promote the reduction of environmental impact in its Resources business.

Supply of environmentally friendly products and services

The boiler control optimization system "ULTY-V plus AT" functions simply by connecting it to existing boilers that use coal, heavy oil, biomass, etc. as fuel in power plants and factories.

The system uses AI (artificial intelligence) to learn and perform a series of self-contained controls (measurement, analysis, and judgment) to improve boiler efficiency, thereby reducing fuel consumption and CO₂ emissions.

The product is sold by NYK Idemitsu Green Solutions Co., Ltd. a joint venture between our company, NYK Line NYK Trading Corporation, Ltd., and Nippon Yusen Kabushiki Kaisha.

Besides Japan, we also sell to Southeast Asia, including Taiwan and Indonesia.

| structure |

|

|---|---|

| effect |

|

| Sales destination |

|

| Seller |

|

Expansion of renewable energy power generation

Tokuyama biomass power generation project initiatives

Our group is engaged in the biomass power generation business as an initiative that contributes to CO₂ reduction through the use of renewable energy and local production and consumption of energy. To date, we have invested in Tosa Green Power Co., Ltd. in Kochi Prefecture and Fukui Green Power Co., Ltd. in Fukui Prefecture, and have developed the Keihin Biomass Power Plant, which utilizes a former Refinery refinery site.

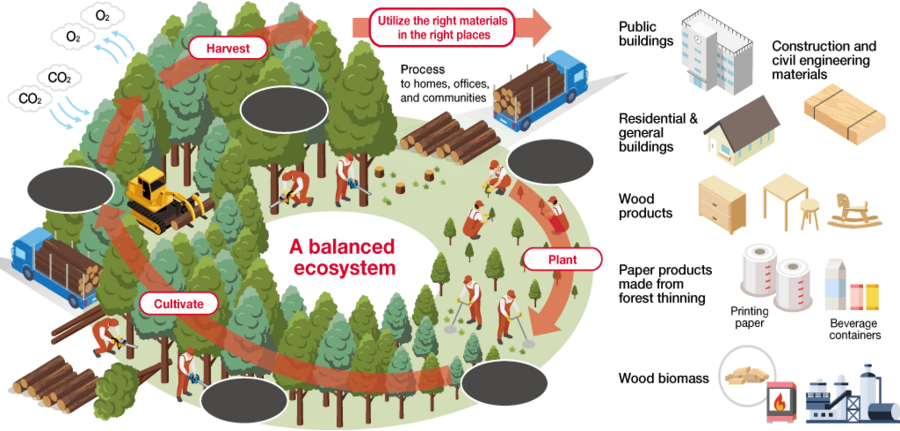

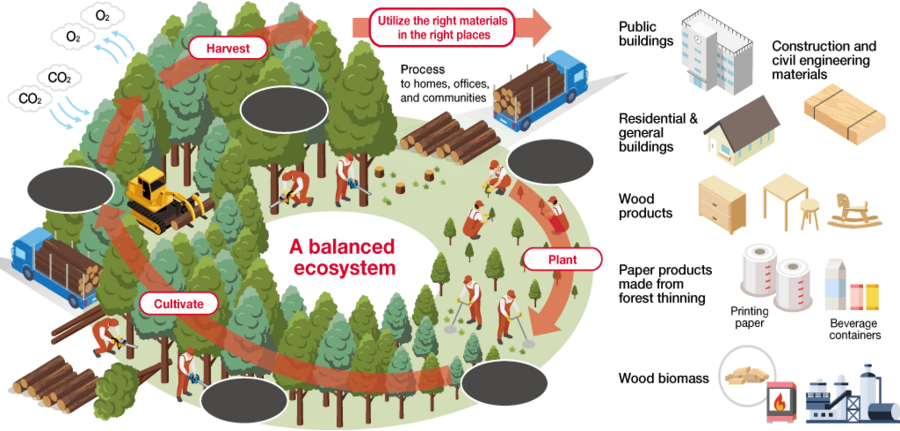

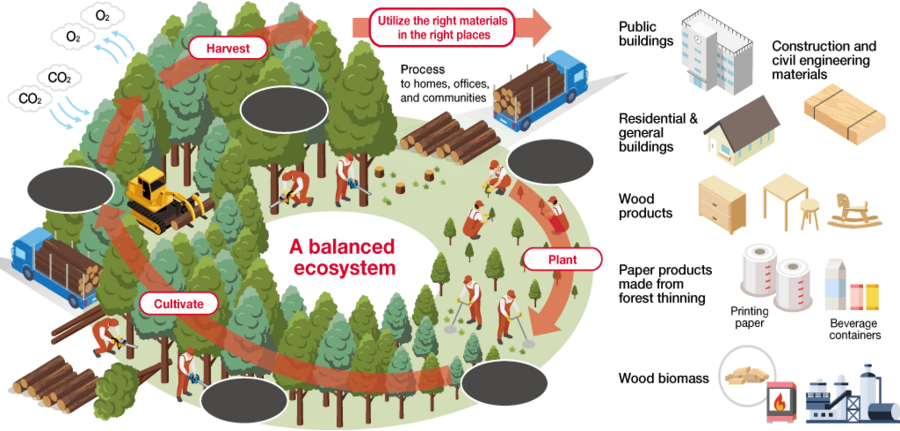

In January 2023, we began commercial operation of the Tokuyama Biomass Power Plant, the group's fourth site. This power plant utilizes part of the site of Refinery (currently Tokuyama Complex), which closed in 2014, and existing infrastructure. Approximately 70% of Japan's land area (37.8 million hectares) is forest, and the utilization of thinned wood that remains unused has been a long-standing issue. For the time being, our company will use imported wood pellets and palm kernel shells (PKS)*, but in the medium to long term, we will use domestically produced thinned wood and sawn wood scraps to create an environment-friendly solution. We will contribute to sustainable forest creation, forestry promotion, and the cyclical use of domestic forest Resources.

In addition, our company has been participating in the Woody Biomass Utilization Promotion Council, which was launched in January 2021 by Shunan City, Yamaguchi Prefecture, since its inception. Taking advantage of the regional characteristics of both abundant forest Resources and biomass power generation facilities, we will work together with local governments to promote the use of domestically produced woody biomass materials, and build and develop a circular economy through local production and local consumption of energy and promotion of forestry. We will continue to contribute to

*Both wood pellets and PKS have obtained third-party certification at the supplier, ensuring sustainability and traceability in production and manufacturing processes, and consideration for the global environment, biodiversity, working environment, etc. Use approved materials.

● Image of the circular use of forest Resources (created by our company based on the diagram in the Forestry Agency's 2021 Forest and Forestry White Paper)

Construction of a geothermal power plant in Yuzawa City, Akita Prefecture

As part of our geothermal business expansion, we have decided to move forward with the construction phase of a geothermal power plant (named Katatsumuriyama Power Plant, output: 15,000 kW) in Yuzawa City, Akita Prefecture, in collaboration with INPEX Corporation and TEPCO Renewable Power, Inc. The plant will be constructed on Mt Snail and operated by Oyasu Geothermal Co., Ltd., a joint venture between the three companies, with operations scheduled to begin in 2027. Results of a 2021 blowout test (demonstration test for evaluating production capacity) indicated that stable production of geothermal fluids (steam and hot water) equivalent to approximately 15,000 kW of output is expected over the long term. We will consider utilizing the renewable energy FIT (feed-in tariff) system for the electricity generated. Furthermore, we will contribute to the local community by designing the Katatsumuriyama Power Plant with consideration for the environment and landscape. Geothermal power generation, unlike other renewable energy sources such as solar power generation, is an energy source that can provide a stable supply of electricity unaffected by weather conditions, and expectations have been growing in recent years. We will continue to actively promote the spread and expansion of renewable energy, and hope to contribute to Japan's energy security and the realization of a low-carbon society.

Verification of commercialization of pumped storage hydropower generation at the Musselbrook coal mine site

Leveraging its business base in Australia, the company is considering using former mining sites as bases for various renewable energy sources. We have begun a joint feasibility study with Australia's power company AGL Energy for a pumped storage power generation project that will utilize the former site of Australia's Musselbrook Coal Mine, which will be completed in 2022. Australia has favorable climate conditions such as wind and sunlight, and is a large country with abundant renewable energy potential, so the Australian government is promoting an energy transition toward decarbonization. In particular, energy storage through pumped storage power generation is expected to contribute to power system stability and play an essential coordinating role in the transition to renewable energy. We will continue to actively respond to Australia's energy transition and work to create low-carbon and decarbonized businesses.

Expanding supply of biomass fuel

Idemitsu Green Energy Pellets

Development and provide for society of innovative technologies

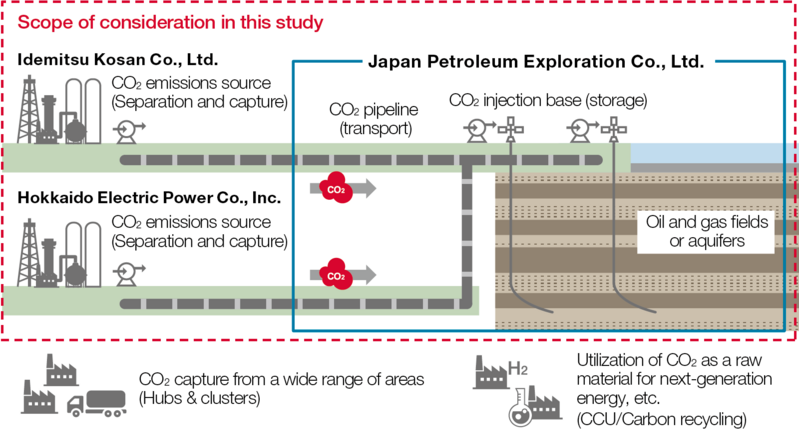

Joint study towards CCUS implementation in Tomakomai area, Hokkaido

Our company, Hokkaido Electric Power Co., Ltd., and Japan Petroleum Resources Co., Ltd. are three companies in the Tomakomai area of Hokkaido that utilize the business bases and strengths of the three companies to develop CCUS (Carbon dioxide Capture, Utilization, and Storage: CO₂ capture and We have started a joint study toward the realization of effective utilization and storage. With a view to launching a CCUS project that connects multiple points in the Tomakomai area by 2030, we are conducting technical studies related to CO₂ emission points, CO₂ recovery equipment, CO₂ transport pipelines, and suitable site surveys for CO₂ storage points. We will proceed with specific investigations and examinations, focusing on the following. In addition to storing CO₂ , we will also take on the challenge of using it as Resources to produce synthetic fuel.

Creating contributions to avoided emissions

To achieve carbon neutrality, we believe it is necessary not only to reduce our own direct emissions from business operations, but also to create "avoided emissions" *1 that contribute to reducing emissions across society through the provision of new products and services. In order to visualize avoided emissions, we have begun calculating the amount of CO₂ avoided emissions based on guidelines *2 issued both domestically and internationally.

For fiscal 2024, we calculated the CO₂ reduction contribution of renewable energy and the boiler control optimization system (ULTY-V plus AT).

We will continue to work to expand the scope of our calculations and contribute to the decarbonization of society by increasing our contribution to avoided emissions.

●FY2024 CO₂ Reduction Contribution Results

Calculation method: Stock basis (single year)

The reduction contribution of renewable energy is calculated based on the emissions for a single fiscal year, based on the actual operation results for fiscal 2024.

| Evaluation target | Contribution to avoided emissions (1,000t-CO₂) |

Calculation formula ※3 |

|---|---|---|

| Solar power | 134 | Actual power generation volume (kWh) x (CO₂ emission coefficient of electricity in each country or area (t-CO₂/kWh) - CO₂ emission coefficient of renewable energy (t-CO₂/kWh)) x our equity ratio (%) |

| Wind-power generation | 19 | |

| Geothermal power generation | 14 | |

| biomass power generation | 173 | (Actual power generation (kWh) x average emission factor in Japan (t-CO₂/kWh) - Actual annual input amount by fuel type (MJ) x GHG emission factor by fuel type (t-CO₂/MJ)) x our equity ratio (%) |

Calculation method: Flow-based (product lifetime)

The reduction contribution of the boiler control optimization system ULTY-V plus AT is calculated by multiplying the product's useful life for products sold in fiscal 2024.

| Evaluation target | CO₂ reduction contribution (1,000t-CO₂) |

Calculation formula ※3 |

|---|---|---|

| Boiler Control Optimization System ULTY-Vplus AT |

1,207 | Boiler fuel consumption (t/year) before the customer installed ULTY-V plus AT x fuel reduction rate due to the installation of ULTY-V plus AT x unit calorific value of fuel (GJ/t) x emission coefficient during fuel combustion (t-CO₂/GJ) x useful life (years) x our equity ratio (%) |

-

A quantification of the contribution to CO₂ emission reductions achieved by providing products and services that contribute to CO₂ reductions compared to providing conventional products and services.

-

Main guidelines used as reference: METI "Guidelines for Quantifying Greenhouse Gas Emissions Avoidance Contributions," Japan Life Cycle Assessment Institute "Guidelines for Calculating Greenhouse Gas Emissions Avoidance Contributions," GX League "Basic Guidelines for Disclosure and Assessment of Climate-Related Opportunities," WBCSD "Guidance on Avoided Emissions"

-

Refer to the IEA (2019) for the average electricity emission factors of each country, and refer to literature values such as documents from the Ministry of the Environment for other emission factors.