Corporate governance

Directors & Officers

Basic approach

Idemitsu Kosan established Vision for 2030" Your Reliable Partner for a Brighter Future" in the previous Medium-term Management Plan (FY2020 to FY2022), and in the Medium-term Management Plan (FY2023 to FY2025) announced in November 2022, we established Vision for 2050" Shaping Change", taking a longer time horizon to realize a carbon neutral and recycling-oriented society in 2050, the future of energy and our ideal state.

By 2050, the global transition to carbon neutrality will accelerate, increasing the likelihood of major changes in energy systems and social structures. In this process, discontinuous technological innovation and the introduction of new technologies into society will be critical. In response to these challenges, we will promote provide for society and fulfill our "responsibility to support people's lives" and "Responsibility to protect the global environment now and in the future" based on the knowledge we have accumulated through stable energy supply and the trust we have built with local communities.

We will continue to emphasize building good relationships with our stakeholders, including customers, shareholders, business partners, local communities, and employees, by increasing management transparency and pursuing sound and sustainable growth.

Aiming to be "a company that is widely expected and trusted by society," we will comply with the Corporate Governance Code, which aims to promote sustainable corporate growth and enhance medium- to long-term corporate value through dialogue with shareholders. We will also aim for transparent and fair management by frankly discussing the actual status of our management and the environment surrounding our management with our diverse independent outside directors and independent outside Audit & Supervisory Board Member directors, and sincerely incorporating their multifaceted opinions.

Policy

Governance

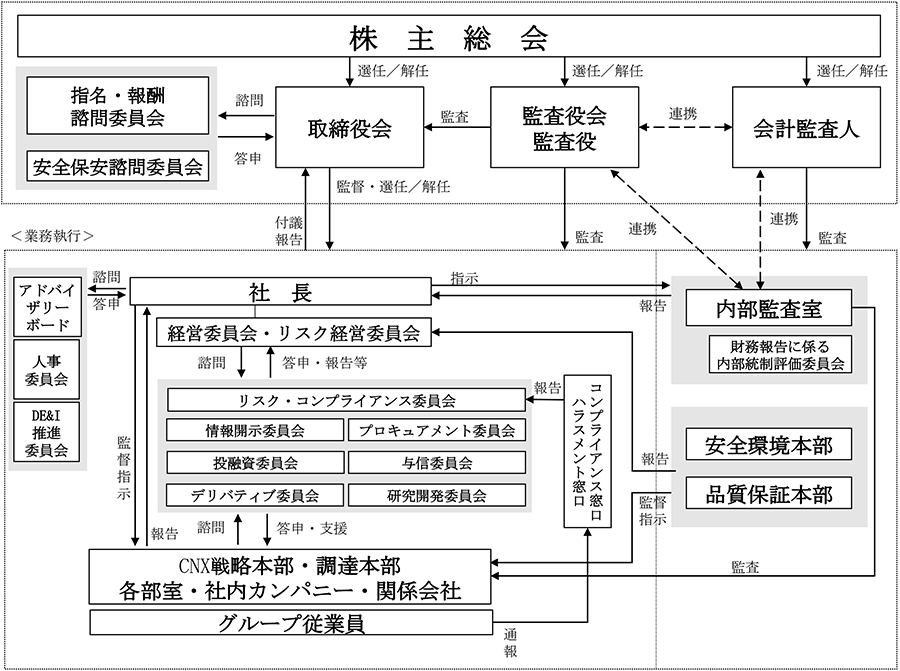

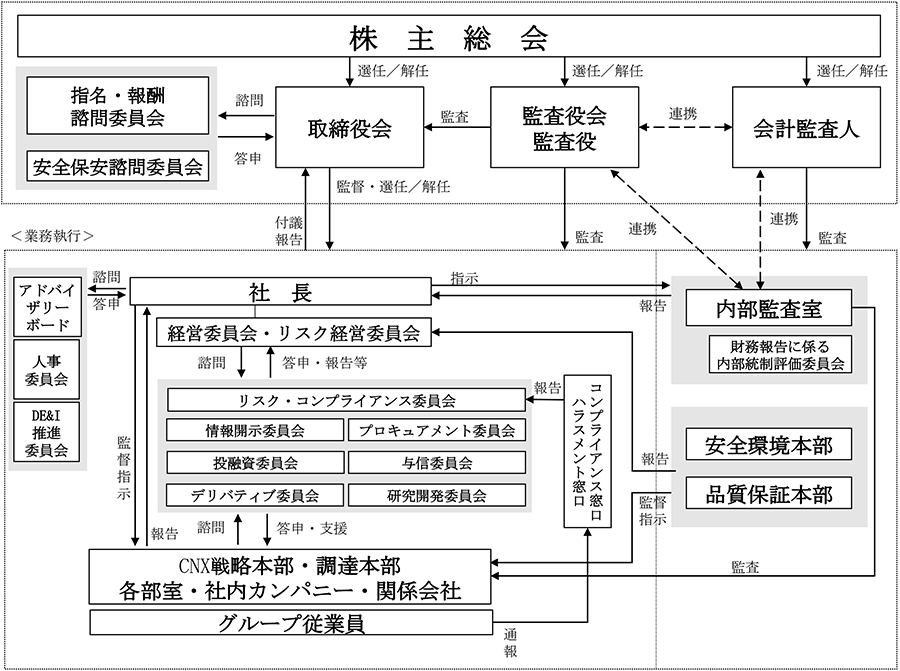

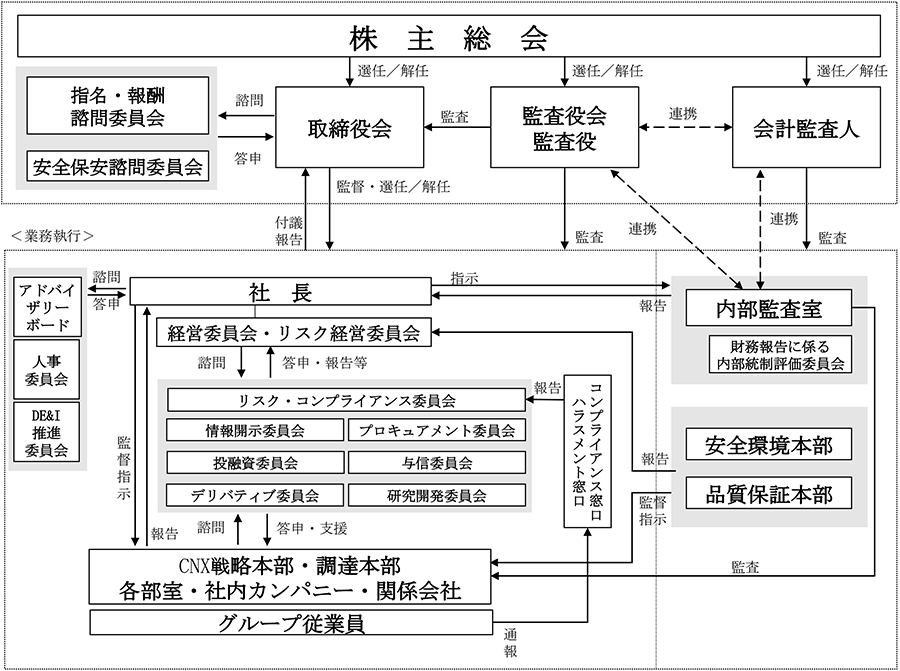

Overview of corporate governance system

At our company, the Board of Directors oversees important decision-making, such as business strategies and business plans, and business execution, in accordance with laws, regulations, the Articles of Incorporation, and rules. The Articles of Incorporation stipulate that the chairman of the Board of Directors will be decided by the Board of Directors and that a director other than the President may be selected as chairman, separating the roles of chairman and president to enhance the objectivity of the Board of Directors. From fiscal 2021, an outside director has served as chairman of the Board of Directors. In addition, to ensure swift decision-making, authority regarding business execution has been delegated to the President, Directors (concurrently Executive Officers), Executive Officers, and Manager.

In addition, the Company Audit & Supervisory Board Member and a board Audit & Supervisory Board Member, who are independent from the board of directors, who audit the execution of duties.

●Corporate governance system diagram

●Overview of the Board of Directors

| Chairman | Takeo Tachikawa (Outside Director) |

|

|---|---|---|

| Number of directors | 11 people | |

| Of which, independent outside directors (ratio) | 4 people (36%) | |

| Of which, women (ratio) | 2 people (18%) | |

| Term of office | 1 year | |

| Number of events held in 2022 | 15 times | |

●Summary of Audit & Supervisory Board Member

| Number Audit & Supervisory Board Member | 4 people | |

|---|---|---|

| Of which, external Audit & Supervisory Board Member (ratio) | 2 people (50%) | |

| Term of office | 4 years | |

| Number of events held in 2022 | 16 times | |

●Corporate governance system transition

Each committee

①Nomination/Remuneration Advisory Committee

In order to increase the transparency and objectivity of functions related to nomination and compensation, we have established the Nomination and Compensation Advisory Committee, which is comprised of independent outside directors, as an advisory body to the Board of Directors. In response to inquiries from the Board of Directors, this committee makes recommendations regarding proposals for the general meeting of shareholders regarding the election and dismissal of directors and Audit & Supervisory Board Member, the appointment and dismissal of executive officers and their positions, and remuneration of directors and revisions to the compensation system. Masu. In fiscal 2022, the event was held a total of seven times.

●Composition and attendance status of the Nomination and Remuneration Advisory Committee (FY2022)

|

|

|

|

|

|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

●Main deliberations and report contents (FY2022)

|

|

|

|---|---|

|

・Review of position structure ・Review of skills and career matrix ・Proposed revision of regulations for executive officers with specific titles ・Succession plan, etc. |

・Extension of stock trust period ・FY2022 Non-financial goals for representative directors, goals for directors in their areas of responsibility ・Revision of executive compensation system (compensation level, composition, performance-based compensation index, etc., stock compensation system) |

●Composition of the Nomination and Remuneration Advisory Committee (FY2023)

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

② Safety and Security Advisory Committee, ③ Advisory Board

In order to maintain management transparency and soundness, we have established a Safety and Security Advisory Committee and an Advisory Board, whose members are outside experts, as advisory bodies to the Board of Directors or the President. Both committees listen to candid opinions from a third-party perspective and reflect them in management improvements.

The Safety and Security Advisory Committee serves as an advisory body to the Board of Directors and reports on issues such as strengthening security in order to prevent large-scale disasters at Refineries/Complexes etc. Ensuring safety and security and stable supply are becoming increasingly important in the face of increasingly severe natural disasters. Therefore, we select themes and issues based on the latest knowledge and information, and a working group established within the Safety and Environment Headquarters takes recommendations from experts and takes countermeasures.

The Advisory Board serves as an advisory body to the president and is comprised of outside experts, including outside directors, and provides an opportunity for outside directors to make recommendations regarding management issues.

④Personnel Committee

As an advisory body to the president, the committee was established to place the right people in the right jobs, such as executive officers, to achieve fair and impartial evaluations, and to strengthen the transparency of the decision-making process. The committee is comprised of the President and Representative Director, the Vice President, the officer in charge of human resources, and the officers designated by the President and Representative Director, and discusses and reports on matters such as the appointment, dismissal, assignment, and evaluation of executive officers, as well as the selection of members of the management committee.

⑤DE&I Promotion Committee

As an advisory body to the president, the committee was established to create an environment in which diverse employees can work energetically and thrive, and to co-create new value. The committee is comprised of directors, officers in charge of human resources, and a variety of executives with different attributes such as gender and job type, and outside directors participate as advisors. We identify issues related to DE&I promotion, make recommendations to management, regularly report to the Board of Directors, and plan and promote company-wide initiatives.

⑥ Management Committee, ⑦ Risk Management Committee

We have established the Management Committee and Risk Management Committee as forums for discussion and consideration of management strategies and management issues for the entire Group and each executive department. Both committees are chaired by the president, and are composed of members who emphasize diversity in their specialized fields and areas of responsibility.The committees are structured to hold comprehensive and effective discussions on cross-divisional issues and risks. .

The "Management Committee" is a deliberative body that plans and considers strategies related to group management and makes important business execution decisions smoothly and appropriately. Additionally, the Risk Management Committee determines and monitors risk management policies related to group management.

Below both committees, committees for each specialized area have been established to discuss issues related to business execution and risk management from a more practical and specialized perspective.

●List of each committee

| Committee name | Chairman | Committee member | Held | Role |

|---|---|---|---|---|

| Management committee | President | Members appointed by the chairperson after deliberation by the Personnel Committee | Principle 3 times/month |

Discussion and examination of management strategies and management issues for the entire group and each executive department, and deliberation of business execution |

| Risk Management Committee | President | Committee members appointed by the chairperson | Principle 2 times/year |

Discussion and consideration of management strategies and management issues for the entire group and each executive department, determination and monitoring of risk management policies |

| Risk and Compliance Committee | General affairs officer | Related department Manager | Principle 4 times/year |

Deliberation and planning of important policies to promote business risk management, response to cases of compliance concerns, compliance promotion activity plans, and monitoring of activity status |

| Information disclosure committee | Public Relations Manager | Relevant directors, executive officers and Manager | Held as necessary | Considering and deciding on disclosure of information, etc. |

| Investment and Loan Committee | General Manager of Corporate Planning Department | Related department Manager | Held as necessary | Deliberation and escalation of matters related to investment and financing, and formulation of investment standards, etc. |

| Derivatives Committee | General Affairs Manager | Related department Manager | Held as necessary | Deliberation of derivative transactions, confirmation and reporting of risk management status |

| Procurement Committee | General Manager of Procurement Department | Related department Manager | Held as necessary | Deliberation and examination of matters related to estimates and orders for services, construction, materials, etc. |

| Credit committee | General Affairs Manager | Related department Manager | Principle 1 time/month |

Measures to collect bad debts, etc., and establishment of basic policies regarding debt management, etc. |

| Research and development committee | Officer in charge of intellectual property and research | Related department Manager | Principle 4 times/year |

Consideration of matters related to the direction, strategy, and issues of company-wide R&D |

| Personnel committee | President | President, Vice President, Officer in charge of Human Resources, and Officers designated by the President and Representative Director | Held as necessary | Improving the transparency, fairness, and fairness of the decision-making process regarding the appointment, dismissal, assignment, and evaluation of executives and the appointment of members of the management committee, etc. |

| DE&I Committee | Vice president | In addition to directors and the executive officer in charge of human resources, the board is comprised of a diverse range of executives with different attributes such as gender and job type, with outside directors also participating as advisors. | Principle 1 time/month |

Identifying issues related to DE&I promotion, making recommendations to management, regular reporting to the board of directors, and planning and promoting other company-wide initiatives. |

Risk management

Overview of the Board of Directors

In FY2022, we announced Medium-term Management Plan covering FY2023 to FY2025. In formulating this plan, the Board of Directors held intensive discussions from the initial stage of plan review to determine the direction of the plan, including the establishment of important themes. Furthermore, we utilized outside officer meetings and the advisory board to deepen discussions at the Board of Directors while collaborating with the management committee and other parties, leading to the formulation of Medium-term Management Plan.

List of main deliberations at the Board of Directors (FY2022)

Management/business strategy

・Impact of sanctions related to the invasion of Ukraine on our transactions and response

・Establishment of Advanced Materials Company with the main purpose of building a technology-based management system and making quick and accurate decisions

・Initiatives to increase the profit contribution of Nghi Son Refinery Petrochemical Limited (NSRP)

・Towards the formulation of Medium-term Management Plan (FY2023-2025)

・Making Toa Oil and Seibu Oil wholly owned subsidiaries

・ Business structure reforms of coal business

・Direction for the future of existing businesses

Governance

・Establishment of Risk and Compliance Committee with the aim of further improving consistency in internal control system discussions (integration of Risk Management Committee and Compliance Committee)

・Revision of the amount and content of performance-linked stock compensation for directors, etc.

・Organizing the overall picture of D&I promotion linked to Management Philosophy, setting KPIs, and measures to strengthen initiatives

・Toa Oil and Showa Yokkaichi Petroleum Quality Test Misconduct Cause Analysis and Recurrence Prevention Measures

・Economic security

・Future measures to further improve the effectiveness of the Board of Directors

IR/Shareholders' Meeting/ Shareholder Returns and Dividends

・Response policy for cross-shareholding listed stocks

・Market reaction after announcement of financial results, etc.

・Summary of the Ordinary General Meeting of Shareholders and Future Direction

・Acquisition and cancellation of treasury stock in line with Shareholder Returns and Dividends policy

・Measures for individual shareholders and institutional investors

-

The above are some of the items to be discussed. In addition to the above, the committee deliberates on matters stipulated by laws and regulations, articles of incorporation, etc., and makes necessary resolutions.

Outside officer meeting

In order to further enhance discussions at the Board of Directors, we held an outside officer meeting consisting of only independent outside directors and independent outside corporate Audit & Supervisory Board Member five times a year to exchange information and share understanding on the following topics.

・Review of internal audit in 2021 and action policy for 2022

・Consideration of CO2 emission targets for formulating Medium-term Management Plan

・Human resources strategy towards 2050

・Medium- and long-term strategy of Advanced Materials Company

・Direction and initiatives that DX should aim for

Evaluation of the effectiveness of the board of directors

A survey targeting all directors and Audit & Supervisory Board Member was conducted in January 2023. Based on these results, we evaluated our efforts in fiscal 2022 to address the issues identified in the previous year, and after discussions three times at the Board of Directors, we identified future issues and confirmed the details of our initiatives.

The questionnaire was conducted not only from the perspective of confirming compliance with the Corporate Governance Code, but also from the perspective of aiming for qualitative satisfaction, and the design of question items and analysis of responses were conducted with the advice of external specialized organizations. Masu.

Effectiveness evaluation process

| Issues extracted in 2021 | Initiatives in 2022 |

|---|---|

| Setting issues with an eye on the medium to long term | Regarding the "setting of issues with an eye on the medium- to long-term" identified in the previous evaluation, we will discuss mid- to long Medium-term Management Plan, including discussions on medium-term management plans, and the direction of new businesses for business structure reforms in order to achieve carbon neutrality in 2050. We continued to discuss and exchange opinions regarding the issues. |

| Further enhancement of information provision that contributes to future management decisions | Regarding "further enhancement of the provision of information that contributes to future management decisions," we also confirmed the progress of our DX strategy and growth Advanced Materials Company companies, etc. based on proposals from outside directors at outside director meetings. Did. Furthermore, we will continue to invite external experts to conduct executive training in fiscal 2021 regarding the latest trends in geoeconomics, economic security, etc., which are becoming increasingly important due to the situation in Ukraine, etc. We have made steady progress in preparing for changes in the environment. |

| Issues extracted in 2022 | How it will be done in the future |

|---|---|

| Responding to management issues | By confirming the progress of Medium-term Management Plan and discussing strategic issues, we will deepen our discussions toward achieving medium- to long-term management issues. As part of this process, we will share information that contributes to strategic discussions even more than ever before at meetings of outside directors, and we will move forward while gaining more feedback and advice from a variety of specialized knowledge. |

| Shareholder/Investor Relations | In order to deepen understanding of our business, we will further improve our ability to disseminate information by creating a platform for individual shareholders, etc., and we will also provide support to outside directors, analysts, and institutional investors in order to improve corporate value over the medium to long term. Through initiatives such as increasing discussions with shareholders and investors, we will enhance both the quality and quantity of communication with shareholders and investors. |

management monitoring

Our management monitoring system includes supervision by the Board of Directors, audits by Audit & Supervisory Board Member, and accounting audits, as well as internal audits by the Internal Audit Department based on the "Internal Audit Regulations" and internal control evaluations based on the "Internal Control Evaluation Regulations for Financial Reporting."

The Internal Audit Office, which reports directly to the President, regularly audits executive departments from an independent standpoint to check the effectiveness of the self-management that each executive department implements based on company regulations, as well as the progress of risk management and internal control. The results of the audits are reported to the President, Audit & Supervisory Board Member, Executive Officer in Charge, and the heads of the relevant executive departments. Executive departments that receive recommendations for improvement during audits prepare improvement implementation plans, submit them to Manager, and make improvements. The Internal Audit Office also conducts follow-up audits as necessary. Annual internal audit reviews and next year's plans are regularly reported to full-time directors and executive department heads at the "Management Information Liaison Meeting," and to outside directors and Audit & Supervisory Board Member at the "External Officer Meeting."

Auditor audit

Audit & Supervisory Board Member (4 people) attend meetings of the Board of Directors, audit business reports, financial statements, and consolidated financial statements submitted to the general meeting of shareholders, and audit the status of business execution by directors and others on a daily basis. Full-time Audit & Supervisory Board Member attend important internal meetings such as the management committee and meet with department managers, overseas store managers, and subsidiary presidents, while external corporate Audit & Supervisory Board Member work to improve audits by conducting on-site inspections of major departments. Masu. As a general rule, meetings are held with the representative director once a quarter to discuss issues and exchange opinions.

Initiatives

Nomination/training of director/ Audit & Supervisory Board Member

Nomination of director candidates

In order to fulfill the roles and responsibilities of the Board of Directors, we need a certain number of directors who are familiar with the Company's business and issues.In order to ensure the independence and objectivity of the Board of Directors, we require diversity in the knowledge, experience, and abilities of the directors. We believe that it is important to ensure that Based on the above idea, we make selections that take into account the overall balance by utilizing human resource standards, skill/career matrices, etc.

The President thoroughly evaluates each candidate's abilities, knowledge, and performance, and then submits a draft proposal to the Nomination and Remuneration Advisory Committee, and the Board of Directors makes decisions based on the recommendations of the Nomination and Remuneration Advisory Committee.

The committee also deliberates on the dismissal of directors as necessary and reports the results to the Board of Directors.

Nomination of Audit & Supervisory Board Member candidates

Candidates will be selected from those who have appropriate experience and ability, as well as the necessary knowledge of finance, accounting, and legal matters. In addition, full-time corporate Audit & Supervisory Board Member candidates will be selected from individuals who are familiar with the Company's business and issues and who can accurately, fairly, and efficiently carry out audits and supervision of the Company. We make selections that take into account overall balance by utilizing human resource standards, skill/career matrices, etc.

The president will submit a draft proposal that fully evaluates the abilities, knowledge, and performance of each candidate to the Nomination and Remuneration Advisory Committee, and the Board of Directors will take into account the Nomination and Remuneration Advisory Committee's report and, with the consent of the Board of Audit & Supervisory Board Member, It has been decided.

Formulation of succession plan

The Nomination and Remuneration Advisory Committee deliberates on the selection and development of next-generation officer candidates based on long-term plans and reports to the Board of Directors. We are currently working on selecting and training candidates, including a succession plan for the president.

Independence standards for outside officers

In order for the Board of Directors to exercise its supervisory function and Audit & Supervisory Board Member to exercise its auditing and supervisory functions, persons who meet the "Independence Standards for Outside Directors and Officers" will provide useful advice to the Company's management, taking into account their diverse knowledge and backgrounds. We have appointed outside officers with the necessary knowledge and experience. Our basic policy is that at least one-third of the board members be independent outside directors, and that at least half of the company Audit & Supervisory Board Member are independent outside corporate Audit & Supervisory Board Member.

Skill/career matrix

While fulfilling our social mission of providing a stable supply of energy, we hope to contribute to the realization of carbon neutrality society by 2050, seize this as a business opportunity, and evolve into a corporate entity that continues to grow sustainably. . To this end, it is extremely important that directors and Audit & Supervisory Board Member with diverse knowledge and experience engage in lively discussions at board meetings to improve the quality of discussions regarding overall management strategy, including human resources strategy.

Since creating and disclosing the skill matrix for directors in 2020, we have continued to review it as appropriate in light of the management issues we face.

In 2023, based on Medium-term Management Plan (FY2023-2025), we reviewed the fields expected of directors and Audit & Supervisory Board Member and selected the fields listed in the table below. With diversity in mind, we appoint officers with knowledge and experience in these fields.

To address issues in areas where the board members are insufficient (fields that require a high level of expertise, such as economic security), we invite outside experts to serve on the advisory board and in executive training.

| Perspective | Expected field | Reasons for selecting it as a promising field |

|---|---|---|

| A perspective that leads to change | Management Philosophy /management strategy | They are required to deeply understand and put into practice the company's management purpose and raison d'être, and to steer management toward realizing Vision for 2050, taking into account economic security, SDGs, DX, etc. perspectives in a discontinuous business environment. |

| Human resource development/DE&I | In order to realize the human resources strategy's goal of ``a human resources group that can flexibly, robustly, and carve out the future no matter what the future may bring,'' it is necessary to promote human resource development and deepen DE&I. | |

| Co-creation/international business | In order to enhance the ability to provide for society in order to realize Vision for 2050, it is necessary to build co-creative relationships with diverse partners, taking into account an international perspective. | |

| Perspectives that support business management | Manufacturing/Research | Knowledge of the safety and environmental aspects of manufacturing, technical knowledge, innovative advanced technology trends, and research areas are required. |

| Sales· | Knowledge of sales, sales, and retail marketing in each business, as well as knowledge of procurement and supply is required. | |

| Governance/Legal | Knowledge of governance from a shareholder perspective, risk management related to business operations, and legal knowledge is required. | |

| Finance/Accounting/Taxation | Knowledge of finance, accounting, and taxation is required to help ensure capital efficiency and profitability. |

●Skills/Career Matrix: Director

| Full name | Tenure period |

Areas in which the Company particularly expects directors | Reasons for selecting promising fields | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Management Philosophy · Management strategy |

Human resource development/ DE&I |

Co-creation/ international business |

Manufacturing/ the study |

Sales· supply |

Governance/ legal affairs |

Financial accounting· Taxation |

|||

| Shunichi Kito [Reappointment] |

10 years | ● | ● | ● | ● | As president, he led business integration, and with his insight gained from his experience as a director in charge of accounting, human resources, and fuel business divisions, he is expected to lead the formulation and execution of growth strategies to realize Vision for 2050. | |||

| Susumu Nibuya [Reappointment] |

3 years | ● | ● | ● | He has a thorough understanding of our company's business and its challenges based on his management experience as Vice President, his insight as the Director of Sustainability, Mobility and Local Community Strategy, his experience as Chair of the D&I Promotion Committee, and his expertise as Head of the Internal Audit Manager of a listed company, and is expected to lead the company in executing our strategies. | ||||

| Atsuhiko Hirano [Reappointment] |

3 years | ● | ● | ● | Due to his experience as president of a business company, his insight as an officer in charge of corporate planning, and his extensive international business experience in key positions in the solar and Petroleum divisions, he is expected to be able to promote structural reforms in our business, including building co-creative relationships. | ||||

| Noriaki Sakai [Reappointment] |

2 years | ● | ● | ● | Due to his deep knowledge and expertise gained through his experience in the accounting and finance departments, as well as his insight gained through his experience in the human resources department, he is expected to help strengthen the company's management foundations for sustainable development, including business structure reforms and investments in human capital. | ||||

| Masahiko Sawa [Reappointment] |

1 year | ● | ● | ● | Medium- to long-term management strategy planning, international gas business experience, knowledge of technology trends and R&D management, knowledge of the environment (CCS) and Resources circulation, advanced expertise in manufacturing and supply, and insight in building supply chains for provide for society For these reasons, he can be expected to promote business structure reforms as a technology manager. | ||||

| Masakazu Idemitsu [Reappointment] |

4 years | ● | ● | As a member of the founding family, he has a deep understanding of The Origin of Management and the company's raison d'être, and from the perspective of long-term governance as a major shareholder, we can expect him to contribute to sustainable development based on the company's management philosophy and to strengthen its management foundation. | |||||

| Kazunari Kubohara [Reappointment] |

4 years | ● | ● | Due to his expertise in corporate law and social issues as a lawyer, and his familiarity with real estate business, he is expected to strengthen the management foundation based on a multifaceted governance perspective. | |||||

| Takeo Kikkawa [Reappointment] [External] [Independent] |

6 years | ● | ● | ● | As an expert in business administration, especially energy industry theory, I have insight into domestic and international energy transition trends and related advanced technologies, as well as ample insight into corporate management.As an outside director, I have been instrumental in strengthening our company's management base and business structure reforms We can expect a director who will lead the way. | ||||

| Yumiko Noda [Reappointment] [External] [Independent] |

2 years | ● | ● | ● | Due to his management experience and wide-ranging knowledge at a global environmental company, as well as his knowledge of finance at domestic and overseas financial institutions, he can be expected to serve as an outside director to strengthen the Company's management foundations and international business, and supervise efforts to business structure reforms. | ||||

| Maki Kado [Reappointment] [External] [Independent] |

2 years | ● | ● | ● | As an outside director, he can be expected to strengthen investments in human capital and supervise business structure reforms due to his management experience gained through holding important positions at global beverage companies, DE&I practice, rich experience in retail marketing, and wide-ranging insight. | ||||

| Jun Suzuki [New] [External] [Independent] |

- | ● | ● | ● | ● | Based on his knowledge of corporate management and governance through his experience as president and chairman of a global chemical company, and his knowledge of a wide range of businesses such as chemicals and pharmaceuticals, as well as related technology, he is able to strengthen the company's management base and supervise business structure reforms as an outside director. can be expected. | |||

| Full name | Tenure period |

Areas in which the Company particularly expects directors | Reasons for selecting promising fields |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Management Philosophy/ Management strategy |

Human resource development/ DE&I |

Co-creation/ international business |

Manufacturing/ the study |

Sales/ supply |

Governance/ legal affairs |

Financial accounting/ Taxation |

|||

| Shunichi Kito [Reappointment] |

Ten years |

● | ● | ● | ● | As president, he led business integration, and with his insight gained from his experience as a director in charge of accounting, human resources, and fuel business divisions, he is expected to lead the formulation and execution of growth strategies to realize Vision for 2050. | |||

| Susumu Nibuya [Reappointment] |

3 years |

● | ● | ● | He has a thorough knowledge of our business and its issues, based on his management experience as vice president, his insight as an officer in charge of sustainability, mobility, and regional community strategies, his experience as D&I promotion committee chair, and his expertise as head of the internal audit office of a listed company. We can expect this to lead to implementation. | ||||

| Atsuhiko Hirano [Reappointment] |

3 years |

● | ● | ● | Due to his experience as president of a business company, his insight as an officer in charge of corporate planning, and his extensive international business experience in key positions in the solar and petroleum divisions, he is expected to be able to promote structural reforms in our business, including building co-creative relationships. | ||||

| Noriaki Sakai [Reappointment] |

2 years |

● | ● | ● | Due to his deep knowledge and expertise gained through his experience in the accounting and finance departments, as well as his insight gained through his experience in the human resources department, he is expected to help strengthen the company's management foundations for sustainable development, including business structure reforms and investments in human capital. | ||||

| Masahiko Sawa [Reappointment] |

1 years |

● | ● | ● | Medium- to long-term management strategy planning, international gas business experience, knowledge of technology trends and R&D management, knowledge of the environment (CCS) and Resources circulation, advanced expertise in manufacturing and supply, and insight in building supply chains for provide for society For these reasons, he can be expected to promote business structure reforms as a technology manager. | ||||

| Masakazu Idemitsu [Reappointment] |

Four years |

● | ● | As a member of the founding family, he has a deep understanding of The Origin of Management and the company's raison d'être, and from the perspective of long-term governance as a major shareholder, we can expect him to contribute to sustainable development based on the company's management philosophy and to strengthen its management foundation. | |||||

| Kazuya Kubohara [Reappointment] |

Four years |

● | ● | Due to his expertise in corporate law and social issues as a lawyer, and his familiarity with real estate business, he is expected to strengthen the management foundation based on a multifaceted governance perspective. | |||||

| Takeo Kikkawa [Reappointment] [External] [Independent] |

6 years |

● | ● | ● | As an expert in business administration, especially energy industry theory, I have insight into domestic and international energy transition trends and related advanced technologies, as well as ample insight into corporate management.As an outside director, I have been instrumental in strengthening our company's management base and business structure reforms We can expect a director who will lead the way. | ||||

| Yumiko Noda [Reappointment] [External] [Independent] |

2 years |

● | ● | ● | Due to his management experience and wide-ranging knowledge at a global environmental company, as well as his knowledge of finance at domestic and overseas financial institutions, he can be expected to serve as an outside director to strengthen the Company's management foundations and international business, and supervise efforts to business structure reforms. | ||||

| Maki Kado [Reappointment] [External] [Independent] |

2 years |

● | ● | ● | As an outside director, he can be expected to strengthen investments in human capital and supervise business structure reforms due to his management experience gained through holding important positions at global beverage companies, DE&I practice, rich experience in retail marketing, and wide-ranging insight. | ||||

| Jun Suzuki [New] [External] [Independent] |

- | ● | ● | ● | ● | Based on his knowledge of corporate management and governance through his experience as president and chairman of a global chemical company, and his knowledge of a wide range of businesses such as chemicals and pharmaceuticals, as well as related technology, he is able to strengthen the company's management base and supervise business structure reforms as an outside director. can be expected. | |||

●Skills/Career Matrix: Audit & Supervisory Board Member

| Full name | Tenure period |

Areas in which the Company particularly expects directors | Reasons for selecting promising fields | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Management Philosophy · Management strategy |

Human resource development/ DE&I |

Co-creation/ international business |

Manufacturing/ the study |

Sales· supply |

Governance/ legal affairs |

Financial accounting· Taxation |

|||

| Tsutomu Yoshioka | 2 years | ● | ● | ● | Based on his experience as president of a business company, as Audit & Supervisory Board Member of a listed company, as an information system department executive, and as Petroleum Marketing Department manager, he is expected to be able to audit the management foundations that support strategy and the DX field. | ||||

| Hidefumi Kodama | 1 year | ● | ● | ● | Due to his experience in medium- to long-term management strategy planning, experience as a financial manager, and experience in international Resources and coal business management, he can be expected to perform audits from a financial/accounting and international business perspective. | ||||

| Taigi Ito [External] [Independent] |

11 years | ● | ● | ● | Due to his extensive experience Audit & Supervisory Board Member at listed companies, his familiarity with the tax and financial matters of listed companies as a certified public accountant, and his experience in auditing global businesses, he is expected to be able to audit management foundations that support strategy and from an international business perspective as Audit & Supervisory Board Member. can. | ||||

| Yumiko Ichige [External] [Independent] |

1 year | ● | ● | As a lawyer, she is well-versed in the governance of listed companies, actively promotes the empowerment of women, is well-versed in the field of intellectual property, and has experience as Audit & Supervisory Board Member she can be expected to audit the management foundations that support strategy. | |||||

| Full name | Tenure period |

Areas in which the Company particularly expects directors | Reasons for selecting promising fields |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Management Philosophy/ Management strategy |

Human resource development/ DE&I |

Co-creation/ international business |

Manufacturing/ the study |

Sales/ supply |

Governance/ legal affairs |

Financial accounting/ Taxation |

|||

| Tsutomu Yoshioka | 2 years |

● | ● | ● | ● | Based on his experience as president of a business company, as an auditor of a listed company, as an information system department executive, and as Petroleum Marketing Department manager, he is expected to be able to audit the management foundations that support strategy and the DX field. | |||

| Hidefumi Kodama | 1 years |

● | ● | ● | Due to his experience in medium- to long-term management strategy planning, experience as a financial manager, and experience in international Resources and coal business management, he can be expected to perform audits from a financial/accounting and international business perspective. | ||||

| Taigi Ito [External][Independent] |

11 years |

● | ● | ● | Due to his extensive experience as an outside auditor at listed companies, his familiarity with the tax and financial matters of listed companies as a certified public accountant, and his experience in auditing global businesses, he is expected to be able to audit management foundations that support strategy and from an international business perspective as an outside auditor. can. | ||||

| Yumiko Ichige [External] [Independent] |

1 years |

● | ● | ● | As a lawyer, she is well-versed in the governance of listed companies, actively promotes the empowerment of women, is familiar with the intellectual property field, and has experience as a member of the Patent Office Council, so as an outside corporate auditor, she can be expected to audit the management foundations that support strategy. | ||||

-

● indicates an area in which the target Audit & Supervisory Board Member is particularly expected to play an active role. It does not represent all of the subject's background and experience.

training

Our company provides training for directors and corporate Audit & Supervisory Board Member to acquire knowledge about the roles, responsibilities, and compliance expected of directors and corporate Audit & Supervisory Board Member of listed companies.

In addition, we will provide explanations about our business, finances, organization, etc. to those newly appointed as independent outside directors and independent outside corporate Audit & Supervisory Board Member, and strive to create an environment in which they can fulfill their roles and responsibilities. Masu. Furthermore, the Company encourages self-improvement by each Director and Audit & Audit & Supervisory Board Member, provides and mediates training opportunities tailored to each individual Director/ Audit & Audit & Supervisory Board Member, and provides extensive support for necessary expenses.

Executive compensation

Basic policy on executive compensation

Regarding the remuneration of our directors and others (directors and senior executive officers and above), we aim to ensure that the compensation will lead to improvements in company performance and corporate value over the medium to long term, in order to realize the Group's management vision. Our basic policy is to create a remuneration system and decision-making process that is transparent, reasonable, and fair, so that we can fulfill our accountability to stakeholders such as the environment, shareholders, business partners, and employees. Based on this basic policy, the Company's executive compensation system is as follows.

Review of executive compensation system

We will review our remuneration system with the aim of further increasing the sense of contribution of directors, etc. to the Company's medium- to long-term business performance and improvement of corporate value, and will strengthen the link between this Medium-term Management Plan and the remuneration of directors, etc. Revised.

In addition to lowering the fixed remuneration ratio, we have linked performance-based remuneration indicators to the transformation of our business portfolio, the strengthening of capital efficiency, and the further development of our environmental, social and governance initiatives.

(The performance-based stock compensation plan was revised at the general meeting of shareholders in June 2023.)

Compensation level

From the perspective of appointing and securing excellent human resources who will contribute to the realization of the medium- to long-term management vision, and providing appropriate incentives, we review the system as appropriate and appropriate, taking into account changes in the business environment and external survey data.

Compensation determination process

The Company has established the Nomination and Remuneration Advisory Committee, which is comprised of independent outside directors, as an advisory body to the Board of Directors. Based on the committee's report, the Board of Directors determines the amount of remuneration for directors and the method for calculating it. In addition, individual remuneration for corporate auditors is determined through consultation among corporate auditors. Please note that executive remuneration, etc., will be paid within the upper limits of remuneration, etc., resolved at the general meeting of shareholders.

Compensation structure

The remuneration system for the Company's directors (excluding part-time directors and outside directors) and senior executive officers and above emphasizes linkage with performance over short-term and medium- to long-term time frames, and aims to improve corporate value over the medium to long term. In order to appropriately evaluate efforts, compensation consists of ① fixed compensation, ② performance-linked bonuses, and ③ performance-linked stock compensation. The remuneration of part-time directors and outside directors consists only of fixed remuneration from the perspective of ensuring an appropriate supervisory function of determining the appropriateness of business execution from an objective standpoint.

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

●Image of compensation composition ratio for internal directors/senior and above executive officers

●Remuneration system and performance-based remuneration system

| Types of remuneration, etc. | Performance evaluation indicators | Overview | |||

|---|---|---|---|---|---|

| Index | Evaluation weight |

||||

| Fixed | Fixed remuneration | - | - | We will pay a fixed amount of remuneration on a monthly basis depending on your role and responsibilities. | |

| Fluctuation | Short term | Performance-linked bonus | Profitability index * | 40% | The payment amount is designed to vary between 0 and 50%, and is paid in June of each year. |

| Human capital related indicators | 20% | ||||

| Achievement of behavioral goals (directors)/objectives in charge (senior and above executive officers) | 40% | ||||

| Medium to long term | Performance-linked stock compensation | Capital efficiency indicators (ROIC/ROE) | 40% | From the perspective of sharing value with shareholders and sustainably increasing corporate value, we are placing particular emphasis on linking our vision to Vision for 2030 and this Medium-term Management Plan. It is designed to fluctuate within a range of 0 to 50% depending on the degree of goal achievement of financial indicators related to business portfolio conversion and non-financial indicators in line with materiality. In order to provide incentives for directors and others to improve corporate value from a medium- to long-term perspective, stock points are granted in June of each year, and shares are distributed after retirement. |

|

| Fossil fuel business revenue ratio | 20% | ||||

| CO₂ reduction (CN, essential for realizing a recycling-oriented society) |

20% | ||||

| Employee engagement (Evaluation of initiatives aimed at Maximize employee growth and engagement) |

20% | ||||

-

Net income/consolidated operating income belonging to owners of parent company + equity method investment profit/loss excluding inventory valuation effects

Clawback system

In the event that a director, etc. commits serious misconduct or violation, the director, etc. will be required to forfeit the beneficial rights to the shares scheduled to be delivered under performance-linked stock compensation (MARS), or demand the return of the allocated shares and other equivalent money (MARSU). This stipulates that a clawback) is possible.

Total amount of remuneration etc. by officer category

The total amount of remuneration for directors in fiscal 2022, the total amount by type of remuneration, and the number of eligible officers are as follows.

| Classification | Number of people (given name) |

Fixed remuneration (one million yen) |

Performance-based compensation (million yen) | Total amount of compensation etc. (one million yen) |

|

|---|---|---|---|---|---|

| Cash reward | Stock compensation | ||||

| Directors (excluding outside directors) | 8 | 326 | 112 | 129 | 568 |

| Audit & Supervisory Board Member (excluding outside Audit & Supervisory Board Member) | 3 | 62 | - | - | 62 |

| Outside Director/Outside Audit & Audit & Supervisory Board Member | 7 | 92 | 0 | - | 92 |

| Total | 18 | 481 | 113 | 129 | 723 |

| Classification | Number of people (given name) |

Fixed remuneration (one million yen) |

Performance-based compensation (million yen) |

Total amount of compensation etc. (million yen) |

|

|---|---|---|---|---|---|

| Cash reward | Stock compensation | ||||

| Directors (excluding outside directors) | 8 | 326 | 112 | 129 | 568 |

| Audit & Supervisory Board Members (excluding outside auditors) | 3 | 62 | - | - | 62 |

| Outside Director/Outside Audit & Supervisory Board Member | 7 | 92 | 0 | - | 92 |

| Total | 18 | 481 | 113 | 129 | 723 |

-

The table above includes one director (including 0 outside directors) and 2 corporate Audit & Supervisory Board Member (including 1 outside Audit & Supervisory Board Member) who retired at the conclusion of the 107th Ordinary General Meeting of Shareholders held on June 23, 2022. I'm here.

Total amount of remuneration, etc. for those whose total remuneration, etc. is 100 million yen or more

| Full name | Officer classification | Company classification | Fixed remuneration (one million yen) |

Performance-based compensation (million yen) | Total amount of compensation etc. (one million yen) |

|

|---|---|---|---|---|---|---|

| Cash reward | Stock compensation | |||||

| Shunichi Kito | Members of the Board | Submitting company | 90 | 33 | 38 | 162 |

| Susumu Nibuya | Members of the Board | Submitting company | 62 | 23 | 26 | 111 |

| Full name | Officer classification |

Company classification |

Fixed remuneration (one million yen) |

Performance-based compensation (million yen) |

Total amount of compensation etc. (million yen) |

|

|---|---|---|---|---|---|---|

| Cash reward | Stock compensation | |||||

| Shunichi Kito | Director | Submitting company | 90 | 33 | 38 | 162 |

| Susumu Nibuya | Director | Submitting company | 62 | 23 | 26 | 111 |

Cross-held listed stocks

Holdings policy for cross-shareholding listed stocks

The Company holds cross-shareholdings necessary to maintain and expand transactions over the medium to long term, and once a year verifies the suitability of these stockholdings and works to reduce them. Specifically, the company will carefully examine both quantitative evaluations to determine whether the benefits and risks associated with stock ownership are commensurate with the cost of capital, and qualitative evaluations such as improvements in business stability, and the Board of Directors will deliberate and determine whether or not the sale is appropriate. Masu. Regarding stocks that we have decided to sell, we proceed with the sale after obtaining their understanding through thorough dialogue with business partners and taking into consideration the impact on stock prices. As of the end of fiscal 2022, the number of shares held is 12.

Standards for exercising voting rights regarding cross-held listed stocks

The Company's policy for exercising voting rights related to cross-held listed stocks is based on whether the corporate value of both the Company and the cross-shareholding company will be sustainably improved. We will consider the management strategy and business performance of cross-holdings to determine whether sustainable corporate value can be improved, and if necessary, we will exercise our voting rights after receiving an explanation of the proposal. If there is a risk that a cross-shareholding entity's agenda may conflict with the Company's interests, the Company will exercise its voting rights as necessary based on the opinions of independent outside directors and outside experts.