Corporate governance

Directors & Officers

Basic approach

In addition to Vision for 2030 "Your Reliable Partner for a Brighter Future," Idemitsu Kosan formulated Vision for 2050 "Shaping Change" in November 2022, aiming to achieve a carbon-neutral, circular society by 2050. As the global trend toward carbon neutrality accelerates in 2050, it is highly likely that energy systems and social structures will have changed significantly. In the process, many challenges will arise, including discontinuous technological innovation, and there will be a demand for people to deliver new technologies in a form that is acceptable to society.

In response to these social issues and environmental changes, we will fulfill our "responsibility to support people's lives" and "Responsibility to protect the global environment now and in the future" by promoting provide for society based on the knowledge we have cultivated through the stable supply of energy and the relationships of trust with local communities. We will continue to focus on building good relationships with stakeholders, including customers, shareholders, business partners, local communities, and employees, by improving the transparency of our management and striving for healthy and sustainable growth.

The Corporate Governance Code aims to achieve sustainable growth and improve mid- to long-term corporate value through dialogue with shareholders. Our company aims to be "a company that is widely expected and trusted by society," and will fundamentally comply with the Corporate Governance Code.

We will continue to aim for transparent and fair management by frankly discussing the actual state of our management and the environment surrounding it with our independent outside directors and independent outside Audit & Supervisory Board Member who have diverse knowledge and backgrounds and by sincerely incorporating their opinions.

Policy

Governance

Overview of corporate governance system

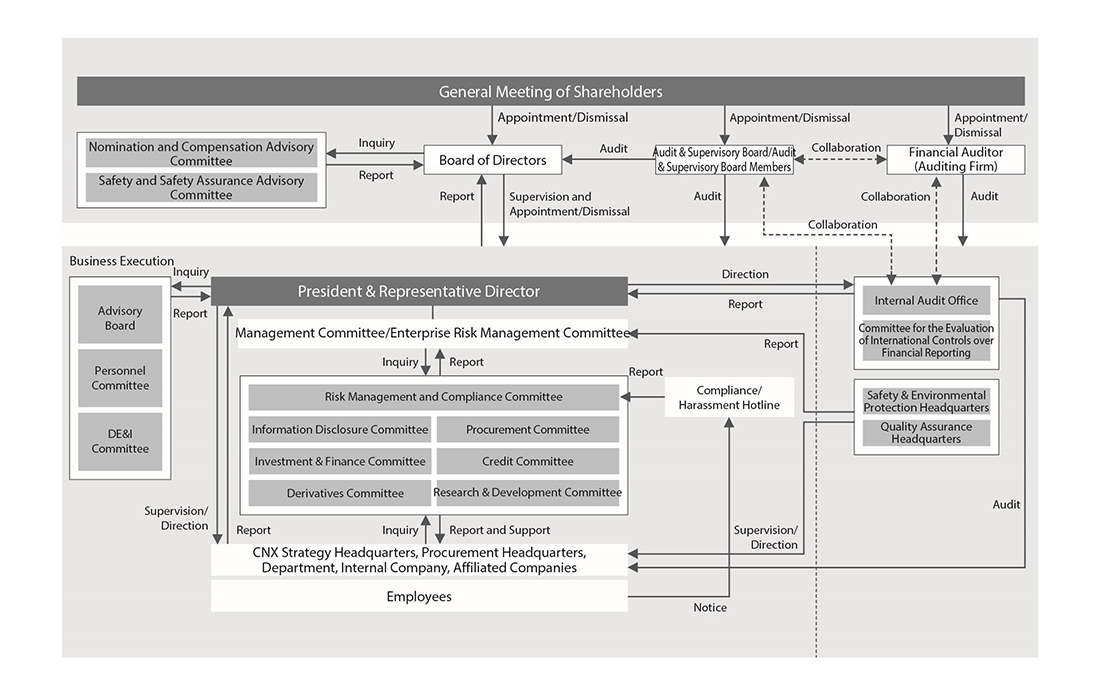

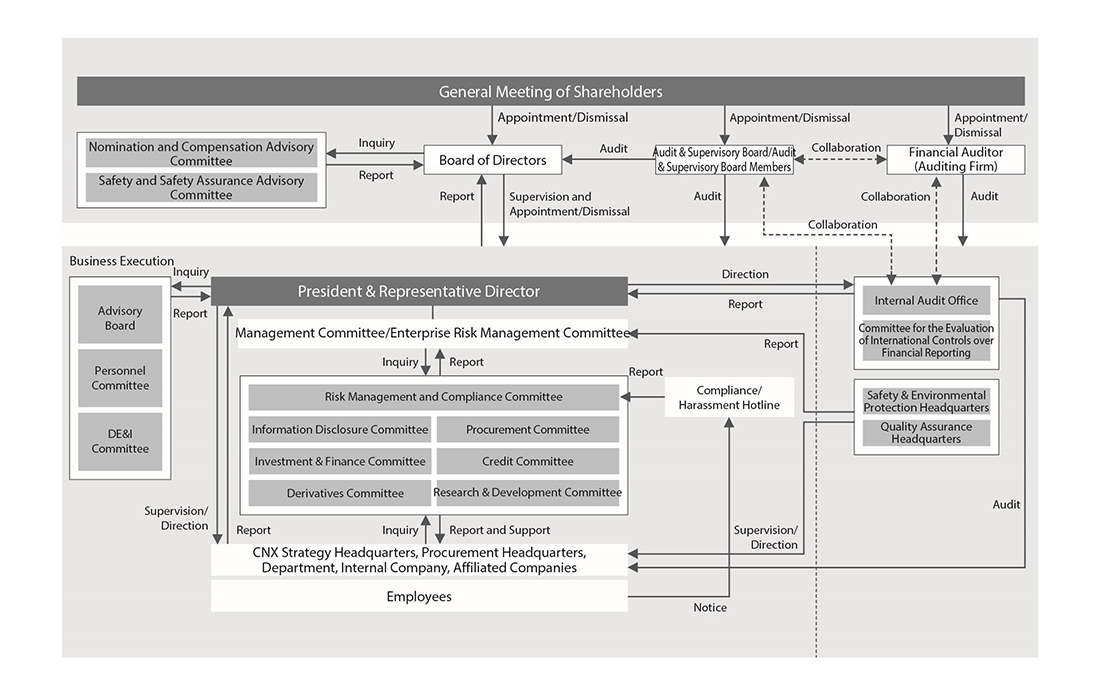

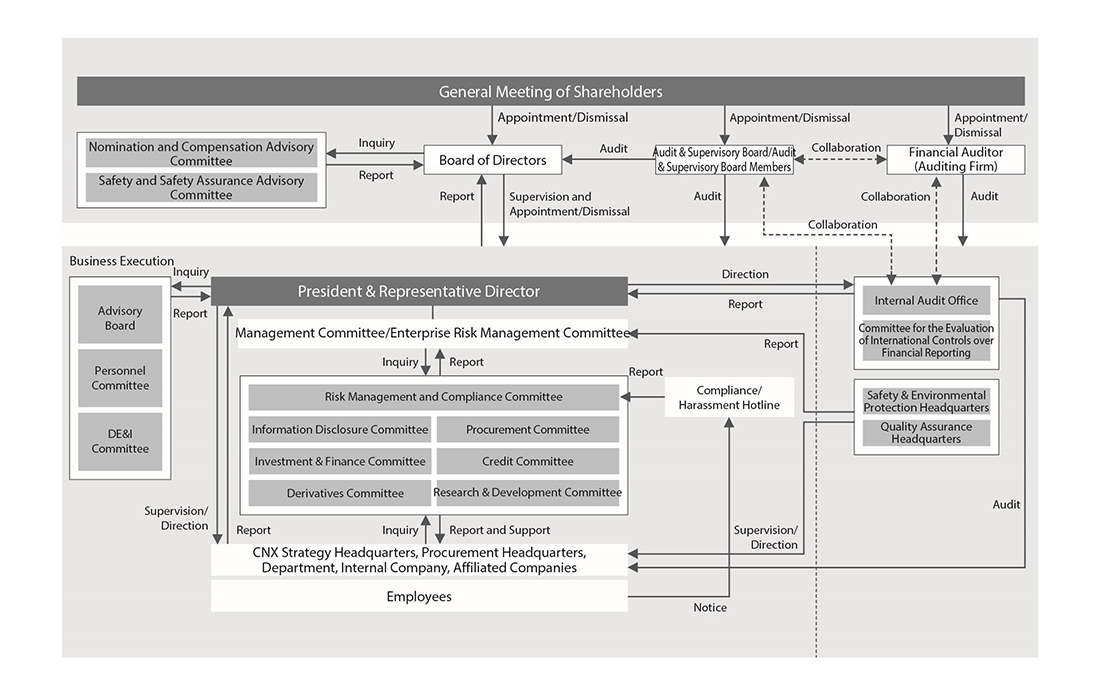

At our company, the Board of Directors oversees important decision-making, such as business strategies and business plans, and business execution, in accordance with laws, regulations, the Articles of Incorporation, and rules. The Articles of Incorporation stipulate that the chairman of the Board of Directors will be decided by the Board of Directors and that a director other than the President may be selected as chairperson, separating the roles of chairman and president to enhance the objectivity of the Board of Directors. From fiscal 2021, an outside director has served as chairman of the Board of Directors. In addition, to ensure swift decision-making, authority regarding business execution has been delegated to the President, Directors (concurrently Executive Officers), Executive Officers, and General Managers.

Moreover, the execution of duties is audited by Audit & Supervisory Board Members and the Audit & Supervisory Board, which remain independent of the Board of Directors.

●Corporate governance system diagram

●Composition of the Board of Directors and the Audit & Supervisory Board

| Fiscal year | Director | Audit & Supervisory Board Member | ||||||

|---|---|---|---|---|---|---|---|---|

| Director | Of which, Outside Director | Percentage of women | Outside Director Ratio |

Audit & Supervisory Board Member | Outside Audit & Supervisory Board Member | Percentage of women | Outside Audit & Supervisory Board Member Ratio |

|

| 2025 | 10 people (8 men, 2 women) |

4 people (2 men, 2 women) |

20% | 40% | 2 people (1 male, 1 female) |

2 people (1 male, 1 female) |

50% | 50% |

| 2024 | 10 people (8 men, 2 women) |

4 people (2 male, 2 female) |

20% | 40% | 2 people (2 male) |

2 people (1 male, 1 female) |

25% | 50% |

| 2023 | 11 people (9 mele, 2 female) |

4 people (2 male, 2 female) |

18% | 36% | 2 people (2 male) |

2 people (1 male, 1 female) |

25% | 50% |

Each committee

Nomination and Compensation Advisory Committee

In order to increase the transparency and objectivity of functions related to nominations and compensation, we have established Nomination and Compensation Advisory Committee which is composed of independent outside directors, as an advisory body to Board of Directors. In response to inquiries from Board of Directors, the committee will submit recommendations to the General Meeting of Shareholders regarding the appointment and dismissal of directors and Audit & Supervisory Board Member, the appointment and dismissal and positions of executive officers with titles, director compensation, and revisions to compensation system. The committee met a total of nine times in fiscal 2024.

Composition and attendance of Nomination and Compensation Advisory Committee (FY2024)

| position | Full name | Attendance | |

|---|---|---|---|

| Chairperson | Outside Director | Jun Suzuki | 9 times/9 times |

| Outside Director | Takeo Kikkawa | 9 times/9 times | |

| Outside Director | Yumiko Noda | 1 time/1 time | |

| Outside Director | Maki Kado | 8 times/9 times | |

| Outside Director | Shiori Nagata | 8 times/8 times |

Main discussions and recommendations (FY2024)

|

|

|---|

|

・Proposal for appointment of advisors ・Revision of the Corporate Governance Basic Policy ・ skill matrix disclosure proposal ・ Appointment of Representative Director and President ・Fiscal 2025 Executive Structure |

|

|

|---|

|

・Setting performance-performance-linked 2024 ・Behavioral goals for directors ・Partial revision of performance-linked indicators for executive officers with titles ・Review of the compensation system for outside officers ・Revision of executive compensation system (compensation levels for executive officers with titles) |

Safety and Safety Assurance Advisory Committee

As an advisory body to the Board of Directors, we report on issues to strengthen safety, especially technical issues, in order to prevent large-scale disasters at Refineries/Complexes. Ensuring safety and security and stable supply against recent, increasingly severe natural disasters are becoming increasingly important. Therefore, we select themes and issues based on the latest information and knowledge, and the working group established within the Safety & Environmental Protection Headquarters receives recommendations from experts and implements measures.

Advisory Board

The committee is made up of external experts and serves as an advisory body to the president, providing an opportunity for external experts to offer suggestions on management issues.

Personnel Committee

The Board was established as an advisory body to the President with the objectives of placing the right people in the right positions for executive officers and other positions, achieving fair and impartial evaluations, and enhancing the transparency of the decision-making process. It is made up of the Representative Director and President, Executive Vice Presidents, and officers appointed by the Representative Director and President, and discusses and reports on matters such as the appointment, dismissal, placement, and evaluation of executive officers and the appointment of members of the Management Committee.

DE&I Committee

In order to create an environment where diverse employees can work with enthusiasm and thrive, and to co-create new value, we have established the DE&I Committee as an advisory body to the President. The DE&I Committee is made up of directors as well as a diverse range of executives with different attributes such as gender and occupation, and outside directors also participate as advisors. The committee identifies issues related to DE&I promotion, makes recommendations to management, reports regularly to the Board of Directors, and plans and promotes other company-wide initiatives.

Management Committee, Enterprise Risk Management Committee

We have established the Management Committee and Enterprise Risk Management Committee as forums for discussing and examining management strategies and issues for the entire Group and each executive division. Both committees are chaired by the President and comprise members who emphasize diversity in their fields of expertise and areas of responsibility, and are structured to hold comprehensive and effective discussions on cross-divisional issues and risks.

The Management Committee is a deliberative body that plans and considers strategies related to the Group's management and ensures smooth and proper decision-making on important business operations, while Enterprise Risk Management Committee determines and monitors risk management policies related to the Group's management.

Subordinate to these two committees are committees in each specialized field for the purpose of discussing issues related to business execution and risk management from a more practical and specialized perspective.

●List of each committee

| Committee name | Chairperson | Committee member | Held | Role |

|---|---|---|---|---|

| Management Committee | President | Members appointed by chairperson after deliberation by Personnel Committee | Principle 3 times/month |

Discussion and examination of management strategies and management issues for the entire group and each executive department, and deliberation of business execution |

| Enterprise Risk Management Committee | President | Committee members appointed by chairperson | Principle 2 times/year |

Discussion and consideration of management strategies and management issues for the entire group and each executive department, determination and monitoring of risk management policies |

| Risk Management and Compliance Committee | General affairs officer | Related General Managers | Principle 4 times/year |

Deliberating and formulating important policies for promoting operational risks management, responding to cases of compliance concerns, planning compliance promotion activities, and monitoring the status of activities |

| Information Disclosure Committee | Public Relations Manager | Related General Managers | Held as necessary | Considering and deciding on disclosure of information, etc. |

| Investment & Finance Committee | General Manager of Corporate Planning Department | Related General Managers | Held as necessary | Deliberation and escalation of matters related to investment and financing, and formulation of investment standards, etc. |

| Derivatives Committee | General Affairs Manager | Related General Managers | Held as necessary | Deliberation of derivative transactions, confirmation and reporting of risk management status |

| Procurement Committee | Chief Procurement Officer | Related General Managers | Held as necessary | Deliberation and examination of matters related to estimates and orders for services, construction, materials, etc. |

| Credit Committee | General Affairs Manager | Related General Managers | Principle 1 time/month |

Measures to collect bad debts, etc., and establishment of basic policies regarding debt management, etc. |

| Research & Development Committee | Officer in charge of intellectual property and research | Related General Managers | Principle 4 times/year |

Consideration of matters related to the direction, strategy, and issues of company-wide R&D |

| Personnel committee | President | President and CEO, Vice Presidents, and officers designated by the President and CEO | Held as necessary | Increase transparency, fairness, and impartiality in the decision-making process for the appointment, dismissal, placement, and evaluation of directors, as well as the appointment of members Management Committee |

| DE&I Committee | Vice president | In addition to directors, a diverse range of people with different attributes such as gender and occupation, as well as outside directors who act as advisors, are also involved. | Principle 1 time/month |

Identifying issues related to the promotion of DE&I and making recommendations to management, regularly reporting to Board of Directors, and planning and promoting other company-wide initiatives. |

Risk management

Overview of Board of Directors

In fiscal 2024, Board of Directors systematically discussed key themes for discussion, including business structure reforms, human resources strategy, evolution of business platforms, and management issues that contribute to improving corporate value, with a view to achieving Medium-term Management Plan (fiscal 2023-2025). Furthermore, in order to accommodate the staged deliberation of important matters, a new deliberation category, "Report (policy inquiry)," was added to the "Resolution" and "Report" categories.

Main matters to be discussed at Board of Directors (FY2024)

| Key themes | Details of deliberations under the directors |

|---|---|

| Business structure reforms |

In addition to proposals related to strengthening the profitability of our existing businesses, we also discussed proposals related to initiatives for CN, investor relations, the general shareholders' meeting, and Shareholder Returns and Dividends. <Major agenda items>

|

| Human capital strategy |

We discussed various personnel system measures to strengthen the connection between our human resources strategy and our management and business strategies. <Major agenda items>

|

| Evolution of business platform |

We discussed proposals that will contribute to the evolution of governance that supports our business platform. <Major agenda items>

|

-

The above are some of the items to be discussed. In addition to the above, the committee deliberates on matters stipulated by laws and regulations, articles of incorporation, etc., and makes necessary resolutions.

Outside Directors Meeting

To further enhance discussions at Board of Directors, we held 10 meetings per year consisting only of independent outside directors and Audit & Supervisory Board Member members to exchange information and share awareness on the following matters.

| theme | Content |

|---|---|

| Business structure reforms | ・Current status and challenges of the domestic Power/renewable energy business ・Lithium battery materials (solid electrolytes) initiative overview ・Distribution structure and Petroleum Marketing Department strategy in the oil industry ・About the ammonia business plan ・ Smart Yorozuya Concept and One-time shop for mobility Business Strategy |

| Human capital strategy | ・Human resource strategies for achieving Medium-term Management Plan |

| Evolution of business platform | ・Risk management and compliance initiatives ・Internal control initiatives (FY2023 review and FY2024 basic policy) ・Mid-term ICT challenges and DX strategies ・Introduction of safety, environment and quality assurance activities, 2024 results and 2025 plans |

Executive Training

In principle, we hold executive training at least once a year, inviting external experts to discuss areas necessary for executives to deliberate on the company's management issues, etc. In fiscal 2024, we held a training session on the theme of changes in the business environment and corporate behavior, with the aim of obtaining suggestions for business structure reforms, and all directors and Audit & Supervisory Board Member participated.

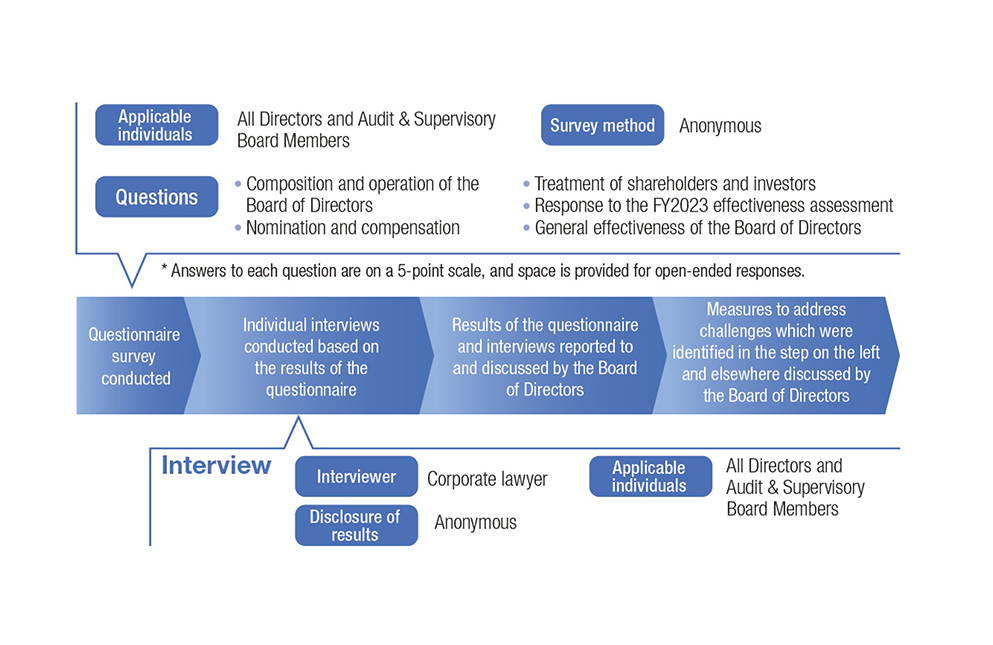

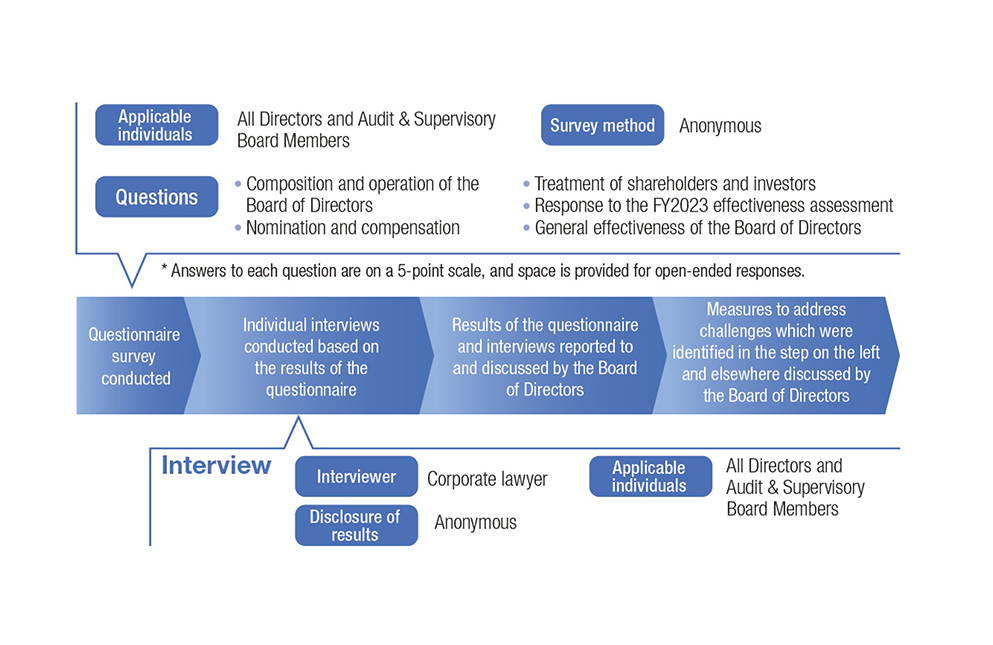

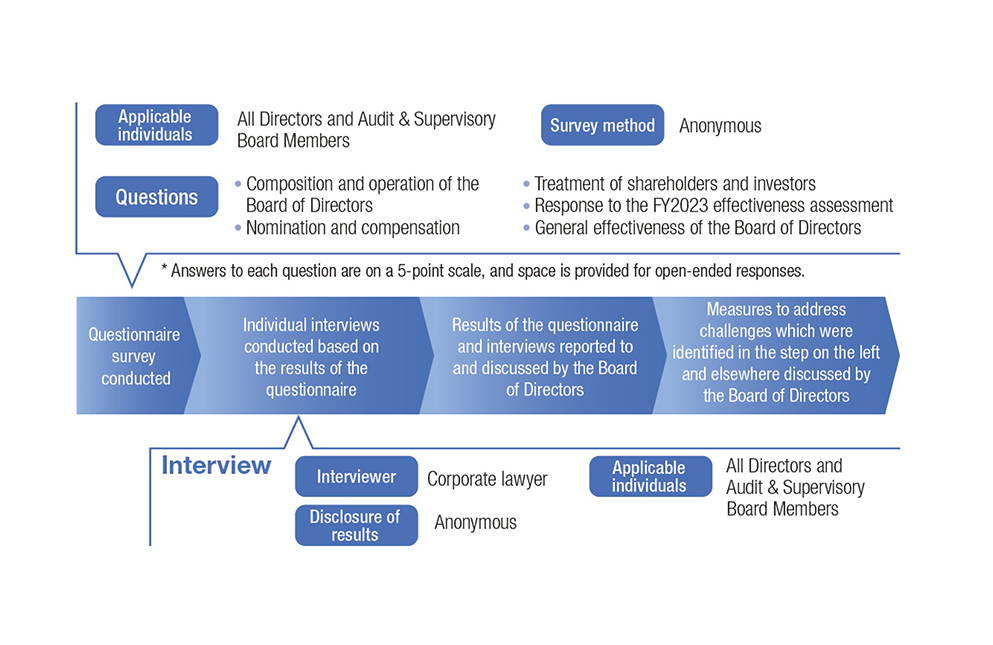

Evaluation of the Effectiveness of Board of Directors

Our company's policy is to have all directors and Audit & Supervisory Board Member evaluate the effectiveness of the entire Board of Directors at least once a year and disclose a summary of the results. We conduct a survey of all directors and Audit & Supervisory Board Member, and strive to review and improve the evaluation process every year to increase the effectiveness of Board of Directors. We receive advice from external specialist organizations when designing the survey items and analyzing the responses.

Individual interviews by corporate lawyers of all outside directors allow us to grasp directors' awareness of issues that could not be discovered through questionnaires alone, leading to discussions on identifying issues and initiatives aimed at further improving the effectiveness of Board of Directors. In fiscal 2024, we expanded the scope of the interviews to include all directors, and collected opinions on issues and responses from both internal and external perspectives in order to further enhance discussions on the company's management issues and strategic discussions.

Details of the effectiveness evaluation process

Evaluation Results

Based on the issues identified in fiscal 2023, in order to further enhance discussions on management issues and strategic debates in fiscal 2024, the Company selected the following key themes to be discussed at meetings of Board of Directors and Outside Officers, etc., and held systematic discussions.

| Business structure reforms |

|---|

| With a view to formulating the next Medium-term Management Plan, the discussion focused on priority projects to be undertaken toward achieving carbon neutrality (Blue Ammonia, e-methanol, SAF, lithium solid electrolytes), growth of existing businesses, and financial and non-financial targets. ・Management strategies based on medium- to long-term environmental forecasts ・Important management issues for sustained improvement of corporate value ・ Medium-term Management Plan ・Business execution status ・ Sustainability |

| Human resource strategies and business platform evolution |

| We also discussed topics that will contribute to the evolution of business platforms, including human capital strategies and DX/IT strategies. ・Human capital strategy ・Succession plan ・Evolution of business platforms ・DX・IT strategy ・Corporate governance ・Risk management |

As a result of the effectiveness evaluation for fiscal 2024, it was determined that the effectiveness of Board of Directors was maintained overall. The issues identified for further improvement of effectiveness were "further strengthening of strategic discussions" and "reporting and deliberation of the overall risk management system." As a result of the discussions, the following specific initiatives will be implemented.

| Further strengthening strategic discussions |

|---|

| In formulating the next Medium-term Management Plan, the overall strategy and key individual issues discussed by the executive team will be discussed in depth at Board of Directors and Outside Directors meetings. We will also work to improve the management of Board of Directors and Outside Directors meetings. |

| Reporting and deliberation on the overall risk management system |

| We will increase the involvement of Board of Directors in risk management policies and responses, and strengthen Board of Directors' oversight function in the operation of the risk management system for overall management. We will also improve reporting and deliberations on serious accidents and problems that have a significant social and financial impact. |

Management monitoring

Our management monitoring system includes supervision by the Board of Directors, audits by Audit & Supervisory Board Member, and accounting audits, as well as internal audits by the Internal Audit Department based on the "Internal Audit Regulations" and internal control evaluations based on the "Internal Control Evaluation Regulations for Financial Reporting."

The Internal Audit Department, which reports directly to the President, regularly audits executive departments from an independent standpoint to check the effectiveness of the self-management that each executive department implements based on company regulations, as well as the progress of risk management and internal control. The results of the audits are reported to the President, Audit & Supervisory Board Member, Executive Officer in Charge, and the General Managers of the relevant executive departments. Executive departments that receive recommendations for improvement during audits prepare improvement implementation plans, submit them to the General Manager of the Internal Audit Department, and make improvements. The Internal Audit Department also conducts follow-up audits as necessary. Annual reviews of internal audits and plans for the next year are regularly reported to full-time directors and general managers of executive departments at the "Management Information Liaison Meeting," and to outside directors and Audit & Supervisory Board Member at the "Outside Officer Meeting."

Audits by Audit & Supervisory Board Members

The four Audit & Supervisory Board Member audit the status of business execution by directors and other executives by attending board meetings and reviewing business reports, financial statements, and consolidated financial statements submitted to the general meeting of shareholders. They also attend important meetings other than board meetings, such as the Management Committee, and conduct daily audits to enhance their effectiveness by meeting with officers, general managers, branch managers, managers of complexes, and presidents and auditors of subsidiaries, and Audit & Supervisory Board Member, as well as on-site inspections of major departments. In principle, meetings are held with the representative director once a quarter to discuss issues and exchange opinions.

●Audit & Supervisory Board Activity Results (FY2024)

| Item | Implementation status for fiscal 2024 | |

|---|---|---|

| Audit & Supervisory Board | 16 times/year | The full-time Audit & Supervisory Board Member shares information on activities and receives information from each department, and the committee confirms management issues and the status of their efforts. [Matters to be resolved] Appropriateness of accounting audits, consent to the reappointment and compensation of accounting auditors, audit policy and plans, audit reports by Audit & Supervisory Board, etc. [Matters for reporting and discussion] Activities of the full-time Audit & Supervisory Board Member, activities of Internal Audit Department, investment review, issues and status of Refinery operations, structure and efforts of the internal control department, etc. |

| On-site inspection (On-site hearing) |

10th Club Room 19 affiliated companies (including 11 overseas companies) 6 external Audit & Supervisory Board Member participated |

We conduct interviews with representatives, executives, and employees of departments and offices responsible for business structure reforms and investments in human capital initiatives, as well as facility inspections, focusing on major affiliated companies, to confirm and discuss the status of management and internal controls.We place emphasis on the status of initiatives related to investments in human capital and the workplace where business structure reforms is being implemented, and share the results of our audits with the executives in charge, encouraging them to utilize them in the management of each business. Additionally, we will continue to visit the refining subsidiary where inappropriate conduct in product quality testing was discovered in fiscal 2022, and are checking the status of the response to the violation of the High Pressure Gas Safety Act that was discovered in fiscal 2024. |

| Meeting with the CEO | 4 times/year (June, September, December, March) |

Audit & Supervisory Board Member share their audit policies and plans and make recommendations based on their audit findings, while the Representative Directors provide explanations on important management issues and exchange opinions. |

| Interviews with executive officers, executive officers, and General Managers | Six executive officers with titles 3 Executive Officers 14 General Managers |

Individual discussions are held with executive officers, executive officers, and General Managers who hold key executive positions, focusing on matters related to the current fiscal year's key audit items, and policies, strategies, and the status of business execution are confirmed. |

In addition, we have a Group Audit & Supervisory Board Member Meeting for the 13 Audit & Supervisory Board Member who are dispatched to affiliated companies, and we collaborate with the General Affairs Department Management Consulting Group, which dispatches non-executive Audit & Supervisory Board Member to 62 affiliated companies both in Japan and overseas.

Initiatives

Nomination and training of candidates for directors and Audit & Supervisory Board Member

Nomination of Candidates for Directors

Board of Directors The Company believes that a certain number of directors who are familiar with the Company's business and issues are necessary to fulfill the roles and responsibilities of the Company's directors, and that it is important to ensure the diversity of knowledge, experience, and abilities of the directors in order to guarantee their Board of Directors independence and objectivity. Based on the above ideas, we use human capital standards, skill matrix and other criteria to ensure that our appointments are balanced across the board.

The draft, on which the President has fully evaluated the abilities, knowledge and performance of each candidate, is submitted to Nomination and Compensation Advisory Committee, and Board of Directors makes a decision based on the report of Nomination and Compensation Advisory Committee.

If necessary, the Committee will also deliberate on the removal of directors and report the results to Board of Directors.

Audit & Supervisory Board Member Nomination of Candidates

Candidates will be selected who have appropriate experience and abilities as well as the necessary financial, accounting, and legal knowledge. In addition, candidates for full-time Audit & Supervisory Board Member positions will be selected who are familiar with the Company's business and issues, and who are able to carry out the Company's auditing and supervision in an accurate, fair, and efficient manner. We utilize human capital standards, skill matrix and other criteria to ensure that our overall selection process is balanced.

The draft, on which the President has fully evaluated the abilities, knowledge and performance of each candidate, is submitted to Nomination and Compensation Advisory Committee, and Board of Directors makes a decision based on the report of Nomination and Compensation Advisory Committee, with the concurrence of Audit & Supervisory Board.

Formulation of Succession Plan

Nomination and Compensation Advisory Committee The committee will deliberate on the selection and development of candidates for the next generation of officers based on the long-term plan at Board of Directors and report back to the committee. Currently, we are working on the selection and development of candidates, including the President's Succession Plan.

Independence Criteria for Outside Directors and Outside Corporate Auditors

Board of Directors In order to ensure that the Company's management is supervised and Audit & Supervisory Board fulfills its auditing and supervisory functions, the Company appoints outside directors who meet the "Criteria for Independence of Outside Directors and Outside Corporate Auditors" and who have the knowledge and experience to provide useful advice to the Company's management, taking into consideration their diverse knowledge and backgrounds. It is our basic policy that the number of independent outside directors should be at least one-third of the total number of directors and the number of independent outside Audit & Supervisory Board Member should be at least half of the total number of Audit & Supervisory Board Member directors.

skill matrix

Board of Directors It is extremely important that the quality of discussions on overall management strategies, including human resource strategies, be enhanced through active discussions among directors and Audit & Supervisory Board Member who have diverse knowledge and experience in the areas of human resource management, human resources, and other areas.

Since the preparation and disclosure of the 2020 Skills Matrix, the Company has continued to review it from time to time in light of the business challenges it faces, and has reviewed the areas in which it expects its officers to perform based on Medium-term Management Plan (FY2023-FY2025). Paying attention to diversity, the Company appoints directors with knowledge, experience, etc. in these areas.

Board of Directors Issues in areas where the members are inadequate (areas requiring a high level of expertise, such as economic security) are supplemented by inviting outside experts at Advisory Board and in executive training.

| Perspective | Expected field | Reasons for selecting it as a promising field |

|---|---|---|

| A perspective that leads to change | Management Philosophy and business strategy | You will be required to have a deep understanding of and put into practice our company's management objectives and raison d'être, and steer management towards realizing Vision for 2050 while also taking into account economic security, SDGs, digital transformation, and other factors in this disruptive business environment. |

| Human resource development/DE&I | In order to realize the human resources strategy's goal of "creating a group of resilient, resilient people who can carve out the future no matter what the future holds," it is necessary to promote human resource development and Expanding DE&I. | |

| Co-creation/international business | In order to increase provide for society capabilities toward realizing Vision for 2050, it is necessary to build co-creation relationships with a variety of partners, taking into account an international perspective. | |

| Perspectives that support business management | Manufacturing/Research | Knowledge of the safety and environmental aspects of manufacturing, technical knowledge, innovative advanced technology trends, and research areas are required. |

| Sales· | Knowledge of sales, sales, and retail marketing in each business, as well as knowledge of procurement and supply is required. | |

| Governance/Legal | Knowledge of governance from a shareholder perspective, risk management related to business operations, and legal knowledge is required. | |

| Finance/Accounting/Taxation | Knowledge of finance, accounting, and taxation is required to help ensure capital efficiency and profitability. |

●Skill Matrix: Director

| Full name | Tenure period |

Areas in which the Company particularly expects directors | As a promising field Reason for adding ● |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Management Philosophy Business Strategy |

Human resource development/ DE&I |

Co-creation/ international business |

Manufacturing/ the study |

Sales· supply |

Governance/ legal affairs |

Financial accounting· Taxation |

|||

| Shunichi Kito [Reappointment] |

12 years | ● | ● | ● | ● | He served as Representative Director and President from 2018 and led the business integration. He will be appointed Representative Board of Directors of the Company in April 2025. With his experience as a director in charge of the accounting, human resources, and fuel business divisions, he is expected to contribute to the promotion of growth strategies to realize Vision for 2050. | |||

| Noriaki Sakai [Reappointment] |

4 years | ● | ● | ● | ● | He will assume the position of Representative Director and President of the Company in April 2025. With his extensive knowledge and expertise gained from his experience in accounting, finance, and human resources, as well as his insight into governance centered on safety and quality assurance, he is expected to strengthen and drive the Company's management foundation toward sustainable development, including business structure reforms and investments in human capital. | |||

| Atsuhiko Hirano [Reappointment] |

5 years | ● | ● | ● | ● | With his experience as president of a business company, his insight as a corporate planning officer, and his extensive international business experience in key positions in the solar and Petroleum divisions, we expect him to be an effective leader in promoting structural reform of our business, including building a co-creation relationship. | |||

| Masahiko Sawa [Reappointment] |

3 years | ● | ● | ● | ● | In addition to his expertise in research and development Manufacturing & Technology Department, he is expected to lead business structure reforms as a technical executive by formulating mid- to long-term management strategies and promoting company-wide CNX as CNX Strategy Headquarters Division. He is also promoting DE&I, including work style reform in Manufacturing & Technology Department. | |||

| Masakazu Idemitsu [Reappointment] |

6 years | ● | ● | As a member of the founding family, he has a deep understanding of The Origin of Management and the raison d'être of the Company, and from the perspective of long-term governance as a major shareholder, we can expect him to contribute to sustainable development based on the Company's management philosophy and strengthening of the Company's management foundation. | |||||

| Kazunari Kubohara [Reappointment] |

6 years | ● | ● | With his expertise as a lawyer in corporate law and social issues, as well as his familiarity with the real estate business, he is expected to strengthen the company's management foundation based on a multifaceted governance perspective. | |||||

| Takeo Kikkawa [Reappointment] [Outside the Company] [Independence] |

8 years | ● | ● | ● | As an expert in business administration, particularly in the energy industry, he has insight into trends in domestic and international energy transitions and related advanced technologies, as well as ample knowledge of corporate management, and as such is expected to provide oversight and advice as an outside director towards strengthening the Company's management foundation and business structure reforms. | ||||

| Jun Suzuki [Reappointment] [Outside the Company] [Independent] |

2 years | ● | ● | ● | ● | As an outside director, he is expected to provide oversight and advice towards strengthening the Company's management foundation and business structure reforms drawing on his knowledge of corporate management and governance gained through his experience as president and chairman of a global chemical company, as well as insight into a wide range of businesses, including chemicals and pharmaceuticals, and related technologies. | |||

| Shiori Nagata [Reappointment] [Outside the Company] [Independent] |

1 year | ● | ● | ● | ● | With his career experience in a wide range of industries, he has a strategic perspective and expertise in corporate planning and management. As an outside director, he is expected to contribute to the promotion of DE&I, strategic advice, organizational improvement, and improvement of the decision-making process at our company. | |||

| Mio Kashiwamura 【new】 [Outside the Company] [Independent] |

- | ● | ● | ● | ● | Having held important positions at global human resources companies, he has extensive experience and wide-ranging knowledge in areas such as management, human resources, public relations, and sustainability, and is expected to provide oversight and advice as an outside director on strengthening human capital initiatives and business structure reforms. | |||

| Full name | Tenure period |

Areas in which the Company particularly expects directors | Reasons for Marking areas of Expectation with ● |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate philosophy/ business strategy |

Human capital development/ DE&I |

Co-creation/ international business |

Manufacturing/ research |

Marketing/ supply |

Governance/ legal affairs |

Finance/ accounting/ tax |

|||

| Shunichi Kito [Reappointment] |

12 years |

● | ● | ● | ● | Served as Representative Director and Chief Executive Officer since 2018, leading management integration. Assumed office as Representative Director and Chairman of the Company in April 2025. The Company expects him to promote growth strategies aimed at realizing the Vision for 2050, based on his insight from his experience as a Director in charge of accounting, human capital, and fuel business. | |||

| Noriaki Sakai [Reappointment] |

4 years |

● | ● | ● | ● | Assumed office as Representative Director and President of the Company in April 2025. The Company expects him to lead and to strengthen management foundations aimed at sustainable development, including business structure reforms and human capital investment, based on his deep knowledge and expertise from past positions in accounting, finance and personnel affairs, and his insight regarding governance involving mainly safe environment and quality assurance. | |||

| Atsuhiko Hirano [Reappointment] |

5 years |

● | ● | ● | ● | The Company expects him to promote business structure reforms, including establishment of a co-creation relationship based on his experience as president of an operating company, his insight from being an officer in charge of corporate planning, and his extensive international business experience in key positions in the solar and petroleum divisions. | |||

| Masahiko Sawa [Reappointment] |

3 years |

● | ● | ● | ● | The Company expects him to promote drafting of medium-to-long term management strategies and company-wide carbon neutral transformation as Head of Carbon Neutral Transformation Strategic Headquarters, and to lead business structure reforms as a technical manager, in addition to providing his expertise for R&D and manufacturing and technology divisions. He also promotes the Company's DE&I, such as workstyle reforms in the manufacturing and technology divisions. | |||

| Masakazu Idemitsu [Reappointment] |

6 years |

● | ● | As a member of the founding family, he has a deep understanding of The Origin of Management and the company's raison d'être, and from the perspective of long-term governance as a major shareholder, we can expect him to contribute to sustainable development based on the company's management philosophy and to strengthen its management foundation. | |||||

| Kazuya Kubohara [Reappointment] |

6 years |

● | ● | Due to his expertise in corporate law and social issues as a lawyer, and his familiarity with real estate business, he is expected to strengthen the management foundation based on a multifaceted governance perspective. | |||||

| Takeo Kikkawa [Reappointment] [External] [Independent] |

8 years |

● | ● | ● | The Company expects him to strengthen its management foundations and supervise as well as advise business structure reforms as an Outside Director, based on his insight related to energy transition trends both in and outside Japan and knowledge of related advanced technologies, and his ample knowledge related to corporate management as an expert in business administration, particularly regarding the energy industry theory. | ||||

| Jun Suzuki [Reappointment] [External] [Independent] |

2 years |

● | ● | ● | ● | The Company expects him to supervise and advise the strengthening of its management foundations and the implementation of business structure reforms as an Outside Director, based on his knowledge of corporate management and governance from his experience as president and chairperson of a global chemical company, and his knowledge of a wide range of businesses such as chemicals and pharmaceuticals and related technologies. | |||

| Shiori Nagata [Reappointment] [External] [Independent] |

1 year |

● | ● | ● | ● | Possesses a strategic perspective and expert knowledge on management planning and administration from her career experience in a wide range of industries. The Company expects her to promote DE&I, provide strategic advice, and contribute to improving the organization and the decision-making process as an Outside Director. | |||

| Mio Kashiwamura [New] [External] [Independent] |

- | ● | ● | ● | ● | Has important positions held at global human capital companies. The Company expects her to provide supervision and advice toward strengthening efforts in the domain of human capital and business structure reform as an Outside Director, based on her extensive experience and wide-ranging knowledge in areas such as management, human capital, public relations and liaison, and sustainability. | |||

●Skill Matrix: Audit & Supervisory Board Member

| Full name | Tenure period |

Areas in which the Company particularly expects directors | As a promising field Reason for adding ● |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Management Philosophy Business Strategy |

Human resource development/ DE&I |

Co-creation/ international business |

Manufacturing/ the study |

Sales· supply |

Governance/ legal affairs |

Financial accounting· Taxation |

|||

| Hidefumi Kodama | 3 years | ● | ● | ● | With experience in mid- to long-term business strategy planning, experience as a financial manager, and experience in international Resources and coal business management, we can expect audits to be conducted from the perspectives of finance, accounting, and international business. | ||||

| Nami Kitamura 【new】 |

- | ● | ● | ● | ● | He has extensive experience in the fields of research, intellectual property, new business promotion, and public relations, and has a wide range of knowledge and expertise. He can be expected to provide audits from the perspectives of corporate divisions and research and new business areas. | |||

| Yumiko Ichige [Outside the Company] [Independent] |

3 years | ● | ● | ● | She has ample experience as an attorney and ample insight into corporate management as an expert in corporate law. In addition, she actively promotes the advancement of women in the workplace and is well versed in the field of intellectual property from her experience as a member of the Japan Patent Office Council. She is expected to provide guidance and audits from the perspective of management strategy, governance, etc. | ||||

| Masahiko Tezuka [Outside the Company] [Independent] |

1 year | ● | ● | ● | ● | He has held important positions at major auditing firms and served as executive director and chairman of the Japanese Institute of Certified Public Accountants. He also has ample experience in auditing global businesses, and as an external Audit & Supervisory Board Member he is expected to provide guidance and audits from the perspectives of management strategy, international business, governance, and more. | |||

| Full name | Tenure period |

Areas in which the Company particularly expects directors | Reasons for Marking areas of Expectation with ● |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate philosophy/ business strategy |

Human capital development/ DE&I |

Co-creation/ international business |

Manufacturing/ research |

Marketing/ supply |

Governance/ legal affairs |

Finance/ accounting/ tax |

|||

| Hidefumi Kodama | 3 years |

● | ● | ● | Due to his experience in medium- to long-term management strategy planning, experience as a financial manager, and experience in international Resources and coal business management, he can be expected to perform audits from a financial/accounting and international business perspective. | ||||

| Nami Kitamura [New] |

- | ● | ● | ● | ● | Possesses extensive experience in such fields as research, intellectual property, promoting new businesses, and public relations, with wide-ranging knowledge and expertise. The Company expects her to provide audits from the perspectives of corporate affairs, research, and new business domains. | |||

| Yumiko Ichige [External] [Independent] |

3 years |

● | ● | ● | Possesses ample experience as an attorney, and has ample knowledge of corporate management as an expert in corporate law. The Company expects her to provide guidance and audits from the perspectives of business strategy, governance, etc., since she actively promotes the empowerment of women in the workplace, and is well versed in the field of intellectual property from her experience as a member of a council in the Japan Patent Office. | ||||

| Masahiko Tezuka [External] [Independent] |

1 year |

● | ● | ● | ● | Has held key positions at major auditing firms, and served as Executive Board Member and Chairman and President of the Japanese Institute of Certified Public Accountants. The Company expects him to provide guidance and audits from the perspectives of management strategy, international business, governance, etc. as outside Audit & Supervisory Board Member, based on his extensive experience in auditing global businesses. | |||

-

●indicates areas to which the Company particularly expects the relevant Director or Audit & Supervisory Board Member to contribute and does not represent all of his/her skill and experience.

Training

We provide and arrange training opportunities and cover the costs for training suited to each Director and Audit & Supervisory Board Member including independent outside Directors and independent outside Audit & Supervisory Board Member, to enable them to acquire the necessary knowledge regarding the Company's business, finances, organization, etc. when they assume their position, to fully understand the roles and responsibilities expected of them, and to continually update them during their term of office.

Executive compensation

Basic Policy on Executive Compensation

Our basic policy regarding the compensation of our directors (directors and senior executive officers) is to ensure that it leads to improvements in company performance and medium- to long-term corporate value in order to realize the Group's management vision, and to ensure that the remuneration system and decision-making process are transparent, reasonable, and fair so that we can fulfill our accountability to stakeholders, including customers, society, the environment, shareholders, business partners, and employees. Based on this basic policy, our executive compensation system is as follows:

Compensation level

We review our system as needed and appropriately, taking into account changes in the business environment and external survey data, from the perspective of promoting and retaining talented personnel who will contribute to the realization of our medium- to long-term management vision, and providing appropriate incentives.

Compensation Decision Process

Based on the recommendations of Nomination and Compensation Advisory Committee, Board of Directors determines the amount of compensation for directors and the calculation method, etc. In addition, compensation for individual Audit & Supervisory Board Member is determined through consultation with Audit & Supervisory Board Member.

In fiscal year 2024, the committee met a total of nine times, and discussions on compensation were held a total of six times.

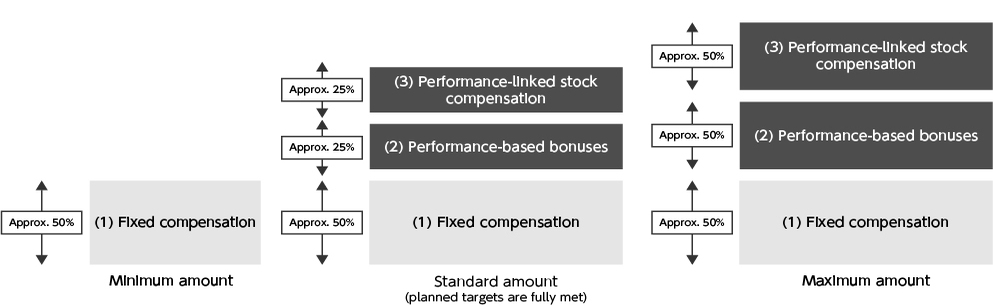

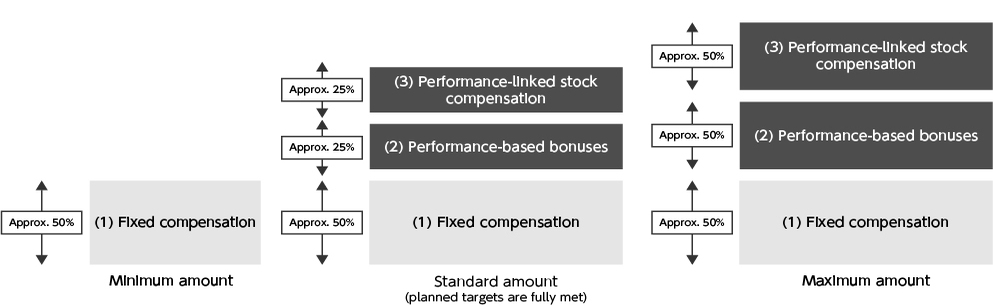

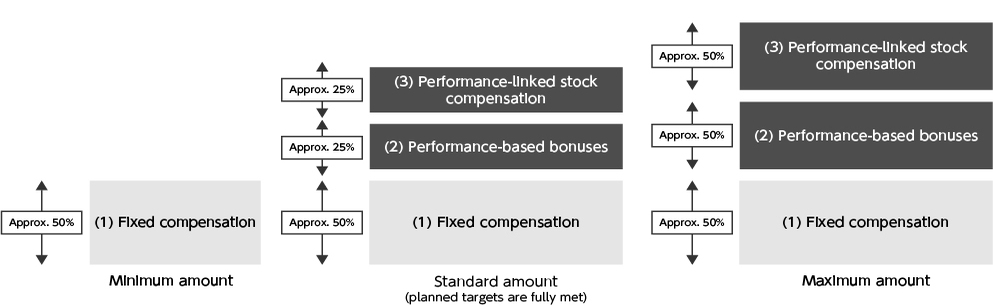

Compensation Structure

compensation system for our directors (excluding non-executive executive directors and outside directors) and executive officers at senior ranks or above places emphasis on performance-linked to short-term and medium- to long-term performance, and in order to properly evaluate management efforts aimed at improving corporate value over the medium to long term, the system consists of (1) fixed compensation, (2) performance-linked bonuses, and (3) performance-linked stock compensation. Note that compensation for non-executive executive directors and outside directors consists solely of fixed compensation, in order to properly ensure the supervisory function of judging the appropriateness of business execution from an objective standpoint.

|

classification |

(excluding non-executive)/ Senior Executive Officers and above |

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

●Image of compensation composition ratio for internal directors (excluding non-executive directors) / senior and above-ranked executive officers

●Compensation system and performance-linked remuneration system

| Types of compensation etc. | Performance evaluation indicators | Overview | |||

|---|---|---|---|---|---|

| Index | Evaluation weight |

||||

| Fixed | Fixed compensation | - | - | compensation will be paid monthly based on role and responsibilities. | |

| Fluctuation | Short term | performance-linked bonuses | Profitability index * | 40% | The payment amount is designed to vary between 0 and 50%, and is paid in June of each year. |

| Human capital related indicators | 20% | ||||

| Degree of achievement of behavioral goals (Directors)/goals in areas of responsibility (Senior and higher ranking executive officers) | 40% | ||||

| Medium to long term | performance-linked stock compensation | Capital efficiency indicators (ROIC/ROE) | 40% | From the perspective of sharing value with shareholders and sustained improvement of corporate value, we place particular emphasis on linking with Vision for 2030 and this Medium-term Management Plan. It is designed to fluctuate within a range of 0-50% depending on the achievement level of financial indicators related to the transformation of the business portfolio and non-financial indicators in line with materiality. In order to provide an incentive for directors and other executives to improve corporate value from a medium- to long-term perspective, stock points are awarded to them every June and shares are issued to them after they leave the company. |

|

| Fossil fuel business revenue ratio | 20% | ||||

| CO₂ reduction (CN, essential for realizing a recycling-oriented society) |

20% | ||||

| Employee engagement (Evaluation of initiatives aimed at Maximize employee growth and engagement) |

20% | ||||

-

Net income/consolidated operating income belonging to owners of parent company + equity method investment profit/loss excluding inventory valuation effects

Clawback system

If any Director, etc. commits an act of material misconduct, violation, etc., we may confiscate the beneficial rights to the shares to be delivered under the performance-linked stock compensation (malus) or demand the return of money equivalent to the shares, etc. delivered (clawback), from the Director, etc.

Total amount of compensation for each executive category

The total amount of compensation for Directors in fiscal year 2024, the total amount by type of compensation, etc., and the number of eligible officers are as follows:

| Classification | Number of people (given name) |

Fixed remuneration (one million yen) |

performance-linked compensation (million yen) | Total amount of compensation etc. (one million yen) |

|

|---|---|---|---|---|---|

| Cash reward | Stock compensation | ||||

| Directors (excluding outside directors) | 7 | 253 | 177 | 135 | 566 |

| Audit & Supervisory Board Member (excluding outside Audit & Supervisory Board Member) | 2 | 62 | - | - | 62 |

| Outside Directors and Audit & Supervisory Board Member | 8 | 97 | - | - | 97 |

| Total | 17 | 412 | 177 | 135 | 726 |

| Classification | Number of people (people) |

Fixed compensation (million yen) |

Performance-linked compensation (million yen) |

Total amount of compensation etc. (million yen) |

|

|---|---|---|---|---|---|

| Cash reward | Stock compensation | ||||

| Directors (excluding outside directors) | 7 | 253 | 177 | 135 | 566 |

| Audit & Supervisory Board Members (excluding outside auditors) | 2 | 62 | - | - | 62 |

| Outside Director/Outside Audit & Supervisory Board Member | 8 | 97 | - | - | 97 |

| Total | 17 | 412 | 177 | 135 | 726 |

-

The above table includes one director (including one outside director) who retired at the conclusion of the 108th Ordinary General Meeting of Shareholders held on June 22, 2023.

Total amount of compensation, etc. for those whose total compensation, etc. is 100 million yen or more

| Full name | Officer classification | Company classification | Fixed remuneration (one million yen) |

performance-linked compensation (million yen) | Total amount of compensation etc. (one million yen) |

|

|---|---|---|---|---|---|---|

| Cash reward | Stock compensation | |||||

| Shunichi Kito | Director | Submitting company | 78 | 54 | 43 | 176 |

| Atsuhiko Hirano | Director | Submitting company | 47 | 33 | 26 | 106 |

| Noriaki Sakai | Director | Submitting company | 47 | 33 | 26 | 106 |

| Full name | Officer classification |

Company classification |

Fixed compensation (million yen) |

Performance-linked compensation (million yen) |

Total amount of compensation etc. (million yen) |

|

|---|---|---|---|---|---|---|

| Cash reward | Stock compensation | |||||

| Shunichi Kito | Director | Submitting company | 78 | 54 | 43 | 176 |

| Atsushi Hirano | Director | Submitting company | 47 | 33 | 26 | 106 |

| Noriaki Sakai | Director | Submitting company | 47 | 33 | 26 | 106 |

Cross-held listed stocks

Policy for holding strategically held listed shares

We hold strategic shareholdings necessary for maintaining and expanding mid- to long-term transactions, and annually review the appropriateness of these shareholdings and proceed with reducing them. Specifically, we carefully examine both quantitatively whether the benefits and risks associated with holding shares are commensurate with the cost of capital, and qualitatively, such as whether they improve business stability, and after deliberation by Board of Directors, we decide whether to sell the shares. In addition, for stocks that we have decided to sell, we proceed with the sale after gaining the understanding of our business partners through sufficient dialogue, taking into account the impact on the stock price.

Number of brands (FY2024)

|

|

|

|---|---|

|

|

|

|

|

|

Standards for exercising voting rights regarding cross-shareholdings

Our policy for exercising voting rights regarding listed cross-shareholdings is based on whether it will sustainably increase the corporate value of both our company and the cross-shareholding. We will determine whether the cross-shareholding will sustainably increase its corporate value, taking into consideration the cross-shareholding's management strategy, performance, etc., and, if necessary, exercise our voting rights after receiving an explanation of the proposal. If there is a risk of a conflict of interest between the cross-shareholding's proposal and our company's interests, we will exercise our voting rights as necessary, taking into account the opinions of our independent outside directors and outside experts.