June 14, 2022

Others

Announcement on the Acquisition of Shares in Seibu Oil Company Limited

Idemitsu Kosan Co., Ltd. (“Idemitsu” or the “Company”) hereby announces that its board passed a resolution on June 14, 2022, to acquire shares in Seibu Oil Company Limited (“Seibu Oil”) to make it a subsidiary, to terminate its product purchase agreement (product sales agreement) with Seibu Oil effective March 31, 2024, on the assumption that the termination of refinery operations at Seibu Oil’s Yamaguchi Refinery in March 2024.

1. Overview and purpose for the acquisition, etc

Pursuant to Idemitsu’s corporate vision for 2030, “Your Reliable Partner for Brighter Future,” the Company is engaging in technological innovation and business restructuring aimed at achieving a carbon neutral society while simultaneously fulfilling its social mission of providing stable energy supply.

Domestic petroleum product demand is expected to decrease further due to structural issues such as the aging and decreasing population, the impact of the COVID-19 pandemic, and global trends towards decarbonization. In light of this evolving operating environment, the Company determined that a revamping of the Idemitsu group’s manufacturing and supply framework is inevitable and that making Seibu Oil a subsidiary of the Company, terminating the product purchase agreement, and terminating refinery operations at Yamaguchi Refinery is the best course of action for Idemitsu.

Until the termination of refinery operations, the Company will continue to contribute to stabilizing regional energy supply and to ensure that Seibu Oil operates safely. New business development using the former site of the Yamaguchi Refinery will be considered after termination of refinery operations, while also continuing the oil tank, storage, and solar power generation businesses. The Company will cooperate with Seibu Oil in such operations and in measures towards the termination of refinery operations at Yamaguchi Refinery. Employment contracts with Seibu Oil employees will remain in place, and the Company expect that they are provided with opportunities to work actively in various capacities within the Company or Idemitsu group refinery and complex.

2. Outline of subsidiary to be transferred (Seibu Oil Company Limited)

| (1) Company name | Seibu Oil Company Limited | |

|---|---|---|

| (2) Address | 7 Kandamitoshiro-cho, Chiyoda-ku, Tokyo | |

| (3) Representative | Representative director and president: Satoshi Handa | |

| (4) Main business | Manufacturing, sales, etc. of petroleum products | |

| (5) Paid-in capital | JPY 8 billion | |

| (6) Established | June 25, 1962 | |

| (7) Major shareholders and shareholding ratio (as of March 31, 2022) |

Idemitsu Kosan Co., Ltd. (38.00%) UBE Corporation (11.00%) The Chugoku Electric Power Co., Inc. (10.79%) Mitsui O.S.K. Lines, Ltd. (5.00%) Mizuho Bank, Ltd. (5.00%) |

|

| (8) Relationship between the listed company and the target | Capital | The Company owns 38% of the target’s shares |

| Personnel | 1 executive director of the Company is also a director of the target | |

| Business | The Company purchases petroleum products produced by the target | |

| (9) Consolidated operating results and financial position of the target over the last 3 years | |||

|---|---|---|---|

| Fiscal year ended | March 2019 | March 2020 | March 2021 |

| Consolidated net assets (JPY millions) | 32,691 | 32,280 | 28,820 |

| Consolidated total assets (JPY millions) | 167,016 | 157,973 | 171,126 |

| Consolidated net assets per share (JPY) | 10,439 | 9,873 | 10,695 |

| Consolidated net sales (JPY millions) | 498,350 | 464,447 | 273,465 |

| Consolidated operating income (JPY millions) | 4,765 | 1,288 | (3,168) |

| Consolidated ordinary income (JPY millions) | 4,950 | 1,471 | (4,421) |

| Net income attributable to owners of the parent

(JPY millions) |

3,518 | 1,072 | (2,971) |

| Consolidated net income per share (JPY) | 220 | 67 | (186) |

| Dividends per share (JPY) | 70 | 60 | 30 |

3. Overview of Seibu Oil Yamaguchi Refinery

- Location

- 5 Nishioki, Sanyoonoda-shi, Yamaguchi Pref.

- Refinery capacity

- Crude distillation unit : 120,000 BD

- Assets owned

- crude oil refinery equipment, crude oil/product tanks, various shipping equipment

- Employees

- 435 (as of April 1, 2022)

4. Overview of the product purchase agreement

- Covered products

- fuel oils (gasoline, kerosine, jet fuel, diesel oil, A type heavy oil, C type heavy oil, LPG), chemical products (xylene, benzene, etc.)

- Purchase volume

- about 5 million KL/year

5. Overview of Counterparties for Stock Acquisitions

| (1) Company name | UBE Corporation | |

|---|---|---|

| (2) Address | 1978-96 Kogushi, Ube-shi, Yamaguchi Pref. | |

| (3) Representative | President & Representative Director: Masato Izumihara | |

| (4) Main business | Manufacturing, sales, etc. of chemical products, construction materials, and machinery | |

| (5) Paid-in capital | 58,435 million yen | |

| (6) Established | March 10, 1942 | |

| (7) Net assets | 394,035 million yen | |

| (8) Total assets | 837,954 million yen | |

| (9) Major shareholders and shareholding ratio (as of September 30, 2021) |

The Master Trust Bank of Japan, Ltd. (trust account) (16.53%) Custody Bank of Japan, Ltd. (trust account) (5.66%) Sumitomo Life Insurance Company (2.05%) Custody Bank of Japan, Ltd. (trust account 7) (1.64%) Nippon Life Insurance Company (1.64%) |

|

| (10) Relationship between the listed company and the target | Capital | None |

| Personnel | None | |

| Business | None | |

| Related party status | Not applicable | |

| (1) Company name | The Chugoku Electric Power Co., Inc. | |

|---|---|---|

| (2) Address | 4-33 Komachi, Naka-ku, Hiroshima-shi, Hiroshima Pref. | |

| (3) Representative | President and Director: Mareshige Shimizu | |

| (4) Main business | Power business, etc. | |

| (5) Paid-in capital | 197,024 million yen | |

| (6) Established | May 1, 1951 | |

| (7) Net assets | 608,445 million yen | |

| (8) Total assets | 3,566,947 million yen | |

| (9) Major shareholders and shareholding ratio (as of September 30, 2021) |

The Master Trust Bank of Japan, Ltd. (trust account) (12.07%) Yamaguchi Prefecture (9.43%) Nippon Life Insurance Company (4.11%) Custody Bank of Japan, Ltd. (trust account) (4.04%) Chugoku Electric Power employee stock ownership association (1.95%) |

|

| (10) Relationship between the listed company and the target | Capital | None |

| Personnel | None | |

| Business | None | |

| Related party status | Not applicable | |

| (1) Company name | Mitsui O.S.K. Lines, Ltd. | |

|---|---|---|

| (2) Address | 2-1-1 Toranomon, Minato-mu, Tokyo | |

| (3) Representative | President and CEO: Takeshi Hashimoto | |

| (4) Main business | Shipping, etc. | |

| (5) Paid-in capital | 65,400 million yen | |

| (6) Established | December 28, 1942 | |

| (7) Net assets | 1,334,866 million yen | |

| (8) Total assets | 2,686,701 million yen | |

| (9) Major shareholders and shareholding ratio (as of September 30, 2021) |

The Master Trust Bank of Japan, Ltd. (trust account) (14.93%) Custody Bank of Japan, Ltd. (trust account) (7.74%) Sumitomo Mitsu Banking Corporation (2.50%) Mitsui Sumitomo Insurance Co., Ltd. (2.35%) MSIP CLIENT SECURITIES (1.61%) |

|

| (10) Relationship between the listed company and the target | Capital | None |

| Personnel | None | |

| Business | None | |

| Related party status | Not applicable | |

| (1) Company name | Tokio Marine & Nichido Fire Insurance Co., Ltd. | |

|---|---|---|

| (2) Address | 2-6-4 Otemachi, Chiyoda-ku, Tokyo | |

| (3) Representative | President & Chief Executive Officer: Shinichi Hirose | |

| (4) Main business | Property and casualty insurance, etc. | |

| (5) Paid-in capital | 101,995 million yen | |

| (6) Established | March 20, 1944 | |

| (7) Net assets | 2,936,346 million yen | |

| (8) Total assets | 9,562,449 million yen | |

| (9) Major shareholders and shareholding ratio (as of September 30, 2021) |

Tokio Marine Holdings (100%) | |

| (10) Relationship between the listed company and the target | Capital | None |

| Personnel | None | |

| Business | None | |

| Related party status | Not applicable | |

| (1) Company name | Kajima Corporation | |

|---|---|---|

| (2) Address | 1-3-1 Motoakasaka, Minato-ku, Tokyo | |

| (3) Representative | President & Representative Director: Hiromasa Amano | |

| (4) Main business | Construction, etc. | |

| (5) Paid-in capital | 81,447 million yen | |

| (6) Established | February 22, 1930 | |

| (7) Net assets | 953,566 million yen | |

| (8) Total assets | 2,337,741 million yen | |

| (9) Major shareholders and shareholding ratio (as of September 30, 2021) |

The Master Trust Bank of Japan, Ltd. (trust account) (14.45%) Custody Bank of Japan, Ltd. (trust account) (5.53%) Kimiko Kajima (3.17%) Custody Bank of Japan, Ltd. (trust account 7) (1.82%) Kajima employee stock ownership association (1.81%) |

|

| (10) Relationship between the listed company and the target | Capital | None |

| Personnel | None | |

| Business | None | |

| Related party status | Not applicable | |

6. Number of shares acquired, acquisition price, and shares held before and after the transaction

| (1) Shares held before transfer | 6,080,000 shares (number of voting rights: 6,080,000) (share of voting rights held: 38%) |

|---|---|

| (2) Number of shares acquired | 4,625,561 shares (number of voting rights: 4,625,561) |

| (3) Acquisition price | Undisclosed (to protect confidentiality) |

| (4) Shares held after transfer | 10,705,561 shares (number of voting rights: 10,705,561) (share of voting rights held: 66.9%) |

7. Schedule

| (1) Board resolution date | June 14, 2022 |

|---|---|

| (2) Stock transfer agreement signing date | June 14, 2022 |

| (3) Stock transfer execution date | Planned for June 14, 2022 |

| (4) Termination of product purchase agreement | Planned for March 31, 2024 |

| (5) Termination of refinery operations | End of March 2024 (approximate timing) |

8. Future outlook

The Company will aim to make Seibu Oil a wholly-owned subsidiary by negotiating with shareholder other than the counterparties listed under “5.” above. The impact of this transaction on the Company’s performance is expected to be currently insignificant. Any future events worthy of disclosure will be announced in a timely manner.

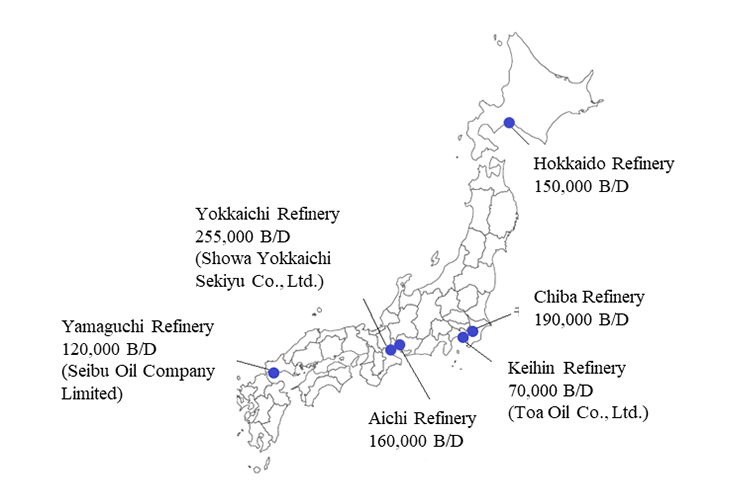

9. The Idemitsu Group's refineries and offices

| Consolidated net sales (JPY millions) |

Consolidated operating income (JPY millions) |

Consolidated ordinary income (JPY millions) |

Net income attributable to owners of the parent (JPY millions) |

|

|---|---|---|---|---|

| Previous Fiscal Year Consolidated Performance (FY 3/2022) |

6,686,761 | 434,453 | 459,275 | 279,498 |

| Current Fiscal Year Consolidated Forecasts (FY 3/2023) |

8,600,000 | 190,000 | 210,000 | 165,000 |

Regarding news release

contact information

Idemitsu Kosan Co.,Ltd. Public Relations Department, Public Relations Division